Transcriptomics Technologies Market, By Replacement Therapy (Estrogen, Human Growth Hormone, Testosterone and Thyroid), By Route of Administration, By Disease, and Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The Transcriptomics Technologies market is estimated to represent a global market of USD 2.69 billion by 2017 with growth rate of 5.5%.

Market Dynamics

Transcriptomics is defined as the study of RNA transcripts that are produced by the genome under specific conditions in specified cell bodies. These transcriptomics datasets are products by various high-throughput methods such as next-generation sequencing and microarray analysis as it usually demands quantitative measurement of thousands of genes. Primary aim behind transcriptome analysis is to identify differentially expressed genes and to gain proper understanding on disease condition.

According to the International Review of Cell and Molecular Biology transcriptomic is aimed to establish the genetic cause of disease conditions by analyzing DNA or RNA profiles through advanced computational models. The industry is majorly driven by the continuous technological up-gradation, rising demand for more compact and reliable products, and the introduction of robust and efficient methodologies. For instance, Affymetrix, Inc. introduced the GeneChip microarray in 1993 and to date, the company is engaged in continuous product modification to achieve higher efficiencies.

Genome Analyzer by Illumina, Inc., AB SOLiD by Life Technologies Corporation, and Roche 454 and HeliScope by Helicos Biotechnologies are the technologically updated system available in the market currently. Furthermore, growing demand for personalized medicine ensures a potential opportunity in the commercialization of transcriptome research results. Despite the industry is on a high growth trajectory, some potential threats exist such as lack of skilled personnel and efficient data tools that will likely to restraint the growth prospects going forward.

Technology Takeaway

In terms of technology, the industry is divided into Polymerase Chain Reaction (PCR), Gene Regulation Technologies, Microarray, and Next Generation Sequencing. PCR (also termed as molecular photocopying) captured the highest share among the different technologies owing to its associated advantages such as high sensitivity, better precision, and cost-effectiveness. The high sensitivity of this technique enables amplification of very small amounts of genetic material samples. Application segment is categorized as Drug Discovery & Research, Clinical Diagnostics, Bioinformatics and Comparative Transcriptomics. Adoption of transcriptomics in drug discovery and research is increasing rapidly and thus this application holds the largest revenue share throughout the review period.

Global Transcriptomics Technologies Market, by Technology, 2017 vs 2025

Regional Takeaway

Regionally, North America, specifically the U.S., accounted for the largest share of the global market. The U.S. is accounted for the one-third of the global biotechnology market. As per the Biotechnology Innovation Organization, more than 2,000 public and private biotechnology companies based in the U.S., where commercial biotechnology research and development activities are growing at steady growth rate. Such facts would, in turn, establish the strong platform for the growth of transcriptomics industry in the country, augmenting the market growth. On another side, the industry in Asia Pacific region is expected to soar as increasing number of key players are preparing to inject new investment.

Key Vendor Takeaway

The industry is consolidated in nature, where a limited number of players control significant revenue share. Key players such as Life Technologies Corporation, Illumina, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., and Affymetrix, Inc. emerged as the prominent players in this market. Of these, Agilent holds highest share (over 20%) of the global transcriptomics market.

Still, in such a consolidated landscape, a large number of small-scale or large-scale players are competing to capture large customer base. In February 2015, Beckman Coulter Inc. launched the service of processing degraded RNA samples of the mouse, human, rat, and plants. This is likely to enhance the clarity on providing a more complete transcriptome analysis.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Hospitals

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY TECHNOLOGY

- Polymerase Chain Reaction (PCR)

- Gene Regulation Technologies

- Microarray

- Next Generation Sequencing

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. TRANSCRIPTOMICS TECHNOLOGIES MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. TRANSCRIPTOMICS TECHNOLOGIES KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. TRANSCRIPTOMICS TECHNOLOGIES INDUSTRY STUDY

4.1. Porter’s Analysis

4.2. Market Attractiveness Analysis

4.3. Regulatory Framework Analysis

5. TRANSCRIPTOMICS TECHNOLOGIES MARKET LANDSCAPE

5.1. Market Share Analysis

6. TRANSCRIPTOMICS TECHNOLOGIES MARKET – BY TECHNOLOGY

6.1. Overview

6.2. Polymerase Chain Reaction (PCR)

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3. Gene Regulation Technologies

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.4. Microarray

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.5. Next Generation Sequencing

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7. TRANSCRIPTOMICS TECHNOLOGIES MARKET– BY GEOGRAPHY

7.1. Introduction

7.2. North America

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.2.3. U.S.

7.2.3.1. Overview

7.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.2.4. Canada

7.2.4.1. Overview

7.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3. Europe

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3.3. France

7.3.3.1. Overview

7.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3.4. Germany

7.3.4.1. Overview

7.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3.5. Rest of Europe

7.3.5.1. Overview

7.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.4. Asia Pacific (APAC)

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.4.3. China

7.4.3.1. Overview

7.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.4.4. India

7.4.4.1. Overview

7.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.4.5. Rest of APAC

7.4.5.1. Overview

7.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.5. Rest of the World

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.5.3. Latin America

7.5.3.1. Overview

7.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.5.4. Middle East and Africa

7.5.4.1. Overview

7.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8. KEY VENDOR ANALYSIS

8.1. Life Technologies Corporation

8.1.1. Company Overview

8.1.2. SWOT Analysis

8.1.3. Key Developments

8.2. Illumina, Inc.

8.2.1. Company Overview

8.2.2. SWOT Analysis

8.2.3. Key Developments

8.3. F. Hoffmann-La Roche Ltd.

8.3.1. Company Overview

8.3.2. SWOT Analysis

8.3.3. Key Developments

8.4. Agilent Technologies, Inc.

8.4.1. Company Overview

8.4.2. SWOT Analysis

8.4.3. Key Developments

8.5. Affymetrix, Inc.

8.5.1. Company Overview

8.5.2. SWOT Analysis

8.5.3. Key Developments

*Client can request additional company profiling as per specific requirements

9. 360 DEGREE ANALYSTVIEW

10. APPENDIX

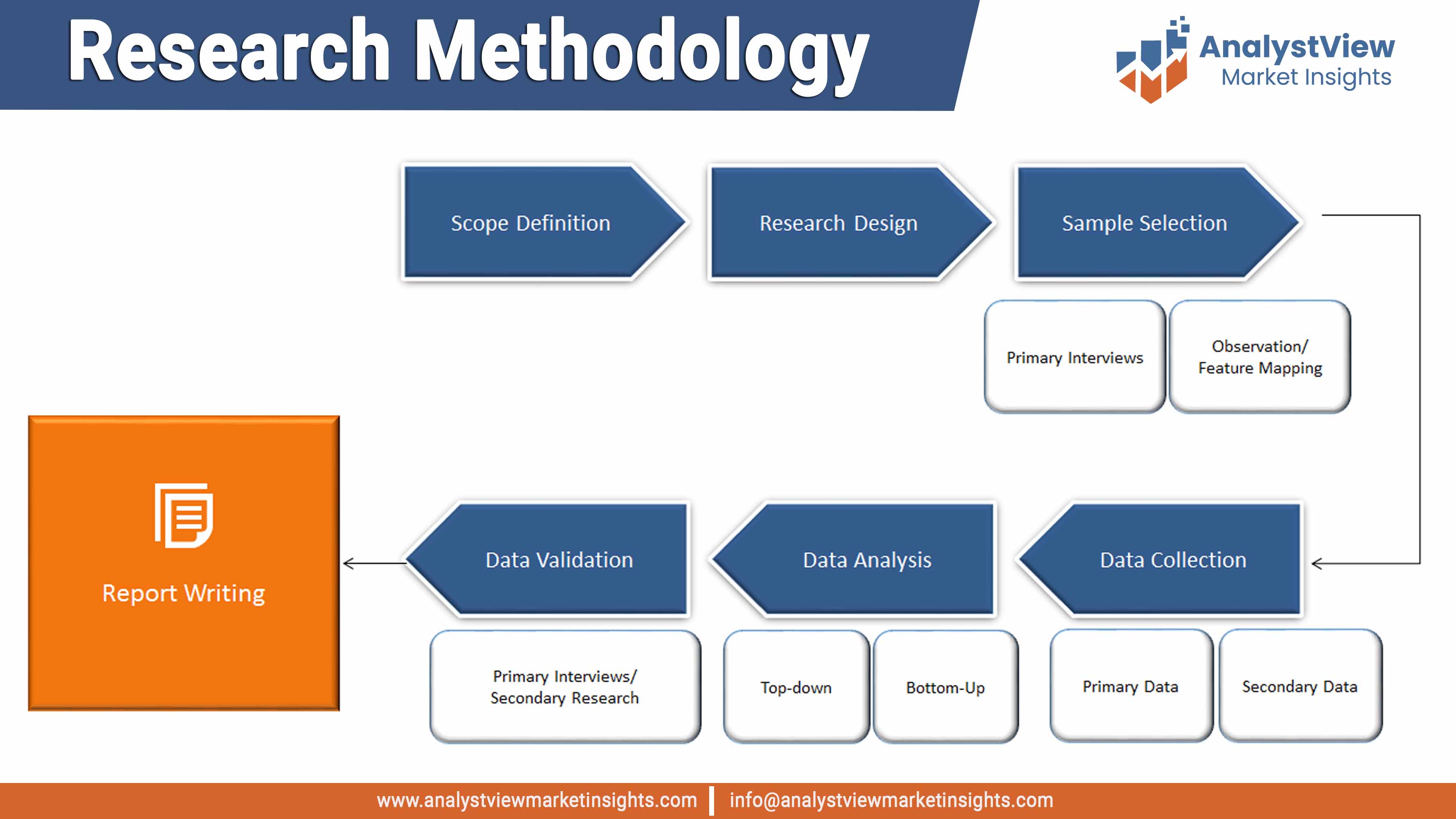

10.1. Research Methodology

10.2. Abbreviations

10.3. Disclaimer

10.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PEST Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global Transcriptomics Technologies Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

Table 10 Transcriptomics Technologies Market, by Tehnology, 2014 – 2025 (USD Billion)

Table 11 Transcriptomics Technologies Market, by Geography, 2014 – 2025 (USD Billion)

Table 12 North America Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 13 U.S. Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 14 Canada Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 15 Europe Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 16 France Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 17 Germany Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 18 Asia Pacific Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 19 China Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 20 India Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 21 Latin America Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

Table 22 MEA Transcriptomics Technologies Market, 2014 – 2025 (USD Billion)

List of Figures

Figure 1 Research Methodology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 Transcriptomics Technologies Market, by Technology, 2014 – 2025 (USD Billion)

Figure 6 Transcriptomics Technologies Market, by Geography, 2014 – 2025 (USD Billion)