White Biotechnology Market, By Product (Biomaterials, Biofuels, Industrial Enzymes and Biochemical), By Application, And Geography (North America, Europe, Asia Pacific, And Rest of the World) Analysis, Share, Trends, Size, & Forecast from 2014 2025

REPORT HIGHLIGHT

The white biotechnology market is estimated to represent a global market of USD 238.9 billion by 2017 with the growth rate of 8.9%.

Market Dynamics

Industrial applications of biotechnology hold many promises for sustainable development. Branch of biotechnology that “uses living cells- from enzymes, yeast, plants, and bacteria to synthesize novel products that require less energy consumption, easily degradable and create less waste during production” is referred as White Biotechnology. Development of this industry is, at present, driven by the growing acceptance of new technology trends such as bioprocess modeling and metabolic modeling. Furthermore, growing awareness regarding environmental and functional benefits of using biofuel in developed and developing economies is predicted to be the major driver for the growth of white biotechnology market.

In addition, factors such as growing demand for bioplastics, favourable government policies, constant research, and innovation to develop effective and high-quality API and cost reduction in production process augment the industry growth significantly. Regulatory authorities are continually striving to improve predictability and efficiency for the future products of biotechnology through their constant efforts. Governments in the U.S., China, Brazil, South East Asia, India, and European countries have implemented several favourable policies of tax reduction and fiscal incentives to promote the white biotechnology applications. For instance, the Executive Office of the President (EOP) introduced a memorandum, on July 2, 2015, directing the primary agencies that regulate the products of biotechnology to update the Coordinated Framework for the Regulation of Biotechnology. The agency is constantly engaged in developing a long-term strategy to ensure that the Federal biotechnology regulatory system is prepared to strengthen the future landscape of biotechnology products.

Product Takeaway

Based on products, the market is divided as Biomaterials, Biofuels, Industrial Enzymes, and Biochemical. Biofuels and biochemical are the largest revenue generating segment. In 2017, these segments have captured more than 70% revenue share of the worldwide white biotechnology industry revenue. Furthermore, the unstable price of conventional fuels such as natural gas, natural oil, and coal has created a prospective opportunity for these segments.

Application Takeaway

The industry finds wide applications in food & feed additive, bioenergy, pharmaceutical ingredients, personal care, and household products. Among which, bioenergy is expected to be the leading application as it eliminates the detrimental environmental effects of fossil-based fuel. Furthermore, the pharmaceutical industry extensively employs white biotechnology in order to develop antibodies, active pharmaceutical ingredients (API), and other complex biomolecules. This segment is anticipated to capture more than 20% revenue share of the global market throughout the study period.

Regional Takeaway

Regionally, North America accounted for the highest revenue share, i.e. 35.23% of the global market in 2017. Functional efficiency, environmental sustainability coupled with easy availability of raw materials are the key factors, stimulating the regional growth. On another hand, Asia Pacific has emerged as a major player in the white biotechnology market in the recent past along with North America and Europe. A large number of developing countries in the Asia Pacific (such as India, Thailand, Philippines, Colombia, Vietnam, etc.) have implemented the law of mandatory blending of biofuel in recent years. Furthermore, many Asia Pacific countries are aiming to increase the blending limit in the coming years. This would, in turn, is predicted to stimulate the demand for biofuel in the future, driving the overall industry growth.

Key Vendor Takeaway

Key players namely BioAmber, Amyris, BASF, Codexis, Evolva, Deinove, Novozymes, Metabolic Explorer, and Solazyme are profiled extensively. These companies are engaged in manufacturing a variety of biomaterials, biofuels, biochemicals and industrial enzymes. Industry rivalry among these players is high. Companies are aggressively investing in research and development activities to expand their product offering and production capabilities, thereby sustaining their market positions. For instance, Royal DSM opened its research and technology center for engineering plastics in Pune, India recently in April 2016. The company aims to support new product and application development through such expansion.

The market size and forecast for each segment has been provided for the period 2014 to 2025, considering 2015 as the base year. The report also provides the compounded annual growth rate (% CAGR) for the forecast period 2016 to 2025 for every reported segment.

The years considered for the study are:

- Historical Year – 2014 & 2015

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, And Suppliers

- Manufacturers

- Hospitals

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Biomaterials

- Biofuels

- Industrial Enzymes

- Biochemical

MARKET, BY APPLICATION

- Food & Feed Additive

- Bioenergy

- Pharmaceutical Ingredients

- Personal Care

- Household Products

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. WHITE BIOTECHNOLOGY MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. WHITE BIOTECHNOLOGY KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. WHITE BIOTECHNOLOGY INDUSTRY STUDY

4.1. Porter’s Analysis

4.2. Market Attractiveness Analysis

4.3. Regulatory Framework Analysis

5. WHITE BIOTECHNOLOGY MARKET LANDSCAPE

5.1. Market Share Analysis

6. WHITE BIOTECHNOLOGY MARKET – BY PRODUCT

6.1. Overview

6.2. Biomaterials

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3. Biofuels

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.4. Industrial Enzymes

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.5. Biochemical

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7. WHITE BIOTECHNOLOGY MARKET – BY APPLICATION

7.1. Overview

7.2. Food & Feed Additive

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3. Bioenergy

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.4. Pharmaceutical Ingredients

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.5. Personal Care Products

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.6. Others

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8. WHITE BIOTECHNOLOGY MARKET– BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.3. U.S.

8.2.3.1. Overview

8.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.4. Canada

8.2.4.1. Overview

8.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3. Europe

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.3. France

8.3.3.1. Overview

8.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.4. Germany

8.3.4.1. Overview

8.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.5. Rest of Europe

8.3.5.1. Overview

8.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.3. China

8.4.3.1. Overview

8.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.4. India

8.4.4.1. Overview

8.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.5. Rest of APAC

8.4.5.1. Overview

8.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.3. Latin America

8.5.3.1. Overview

8.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.4. Middle East and Africa

8.5.4.1. Overview

8.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

9. KEY VENDOR ANALYSIS

9.1. BioAmber

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

9.2. Amyris

9.2.1. Company Overview

9.2.2. SWOT Analysis

9.2.3. Key Developments

9.3. BASF

9.3.1. Company Overview

9.3.2. SWOT Analysis

9.3.3. Key Developments

9.4. Codexis

9.4.1. Company Overview

9.4.2. SWOT Analysis

9.4.3. Key Developments

9.5. Evolva

9.5.1. Company Overview

9.5.2. SWOT Analysis

9.5.3. Key Developments

9.6. Deinove

9.6.1. Company Overview

9.6.2. SWOT Analysis

9.6.3. Key Developments

9.7. Novozymes

9.7.1. Company Overview

9.7.2. SWOT Analysis

9.7.3. Key Developments

9.8. Metabolic Explorer

9.8.1. Company Overview

9.8.2. SWOT Analysis

9.8.3. Key Developments

9.9. Solazyme

9.9.1. Company Overview

9.9.2. SWOT Analysis

9.9.3. Key Developments

*Client can request additional company profiling as per specific requirements

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

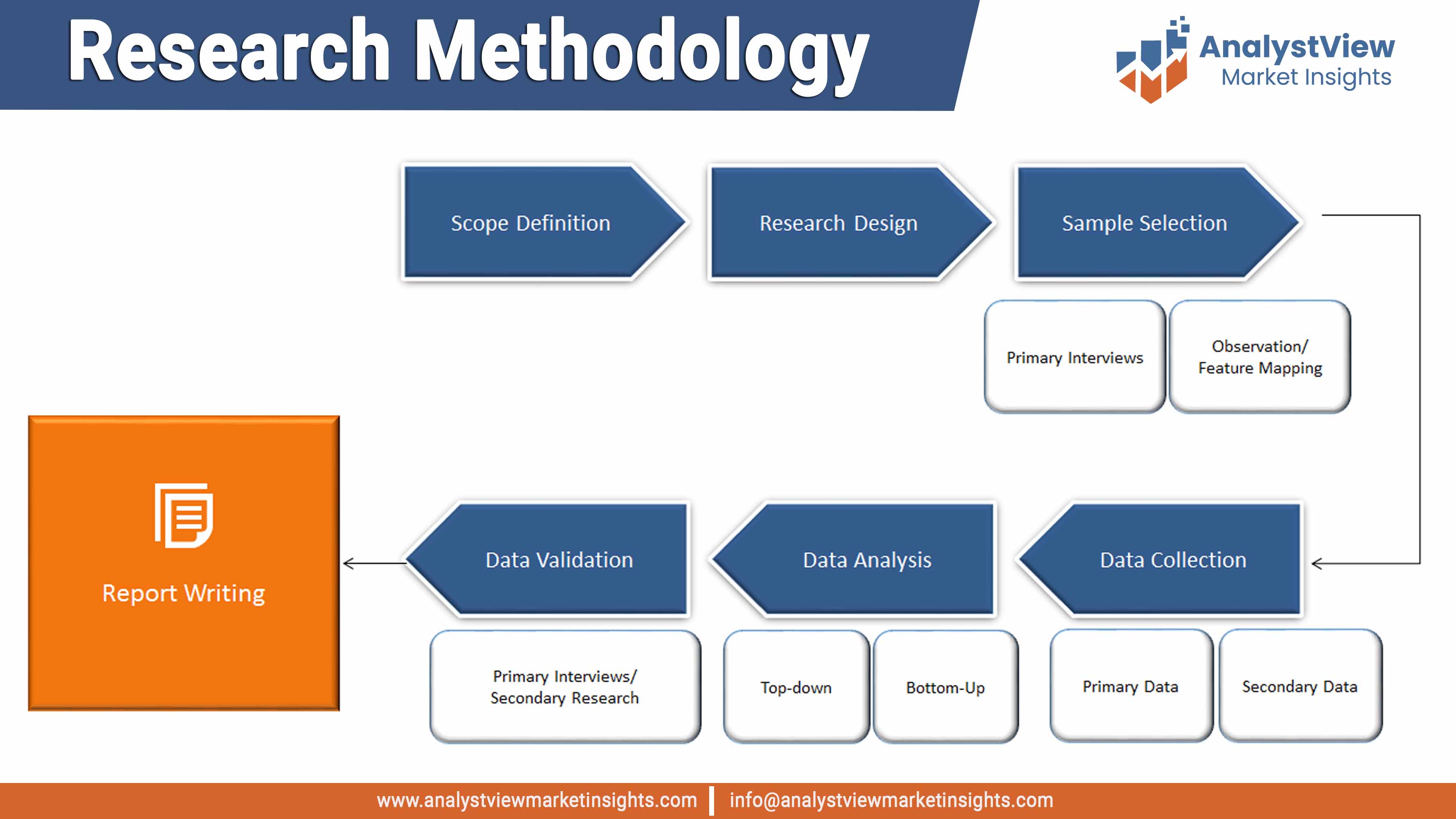

11.1. Research Methodology

11.2. Abbreviations

11.3. Disclaimer

11.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PEST Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global White Biotechnology Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

Table 10 White Biotechnology Market, by Products, 2014 – 2025 (USD Billion)

Table 11 White Biotechnology Market, by Applications, 2014 – 2025 (USD Billion)

Table 12 White Biotechnology Market, by Geography, 2014 – 2025 (USD Billion)

Table 13 North America White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 14 U.S. White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 15 Canada White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 16 Europe White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 17 France White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 18 Germany White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 19 Asia Pacific White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 20 China White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 21 India White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 22 Latin America White Biotechnology Market, 2014 – 2025 (USD Billion)

Table 23 MEA White Biotechnology Market, 2014 – 2025 (USD Billion)

List of Figures

Figure 1 Research Methodology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 White Biotechnology Market, by Products, 2014 – 2025 (USD Billion)

Figure 5 White Biotechnology Market, by Applications, 2014 – 2025 (USD Billion)

Figure 6 White Biotechnology Market, by Geography, 2014 – 2025 (USD Billion)