Aerospace Plastic Market, By Application (Aerostructure, Insulation Components, Components, Cabin Interiors, Satellites, Equipment, Propulsion Systems, Systems & Support and Construction) by End-Use and Geography (North America, Europe, Asia Pacific, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

Report Code: AV311

Industry: Semiconductor and Electronics

Publiced On: 2020-06-01

Pages: 139

Format:

REPORT HIGHLIGHT

The aerospace plastic market was valued at USD 720.8 million by 2017, growing with 4.8% CAGR during the forecast period, 2018-2025.

Market Dynamics

Aerospace plastics are materials which are made to have high durability, and chemical resistant. The surging demand for plastics in different aerospace applications like empennage, cabin interiors, fuselage, and airframe will bolster the market growth in the years to follow. Performance and efficiency of an airplane can be improved by bringing about a reduction in airplane weight. It is believed that if the weight of an airplane is brought down by 1 kilogram then it brings about a substantial reduction in the fuels operating cost associated with a commercial airplane. Plastics have high durability and they are light in weight. They make for a good alternative to steel and aluminum components. With the progression of time, these materials are being extensively used in making the structure of an airplane.

Application Takeaway

Application wise, the market is categorized into aerostructure, insulation components, cabin interiors, components, equipment, satellites, systems & support, propulsion systems, and construction. Reinforced plastic made from carbon fiber and composites is extensively used in the manufacturing of aircraft frame. Hence, it brings about a substantial reduction in weight. Aircraft are vulnerable to fatigues as they function in an environment that is characterized by high-tension load. The use of plastics and extended composites can bring down maintenance overheads. When fuselage is made from engineered polymers it facilitates part-count reduction through the use of integral clips and fasteners.

In terms of volume, supplies, systems, and equipment together had the second largest share. It is closely followed by cabin interiors. Aerospace plastics have strong chemical resistance, anti-corrosive properties, and they are lighter in weight. Thus, they prove to be a befitting alternative to steel, aluminum, and other conventional materials. There is no need for riveting when it comes to assembling polymers into large structures. Bonding is good enough for the purpose.

When it comes to the foundation of an aircraft’s size and shape, aerostructure is the most important part of an airplane. Polyoxymethylene (POM) and polyether ether ketone (PEEK) are the two widely used polymers. Heat and corrosion resistance along with high durability makes them perfect for the purpose. With the rising demand for commercial and general aviation, the demand for polymers will grow significantly in future.

End-Use Takeaway

In terms of end-user, the industry is divided into military aircrafts, general aviation, commercial & freighter aircrafts and rotary aircrafts. One of the major end-user segment of aerospace plastic is commercial aircraft. The segment for military aircraft has bright prospect too. Rising concerns related to defense and security is contributing to its increased utilization. Large aircrafts used in freight transportation are some of the major application areas of plastic in the aerospace industry. Use of polymers in aircraft bring about a reduction in the operating cost by minimizing maintenance overheads. Hence, it has been an encouraging factor for the manufacturers for enhancing the concentration of plastic content in freight and commercial aircraft.

Regional Takeaway

The rising demand for fuel-efficient aircraft in Europe due to surging fuel costs and high replacement rate of regional aircraft will bolster the regional growth. There will be an augmentation of the market growth owing to the emergence of the fuel-efficient airplane. The European industry will keep growing due to the availability of capable engineers, a plethora of investment, strong research and development works. As airplane manufacturing companies are coming to the forefront in the Asia Pacific region, countries like China and India will push the market of aerospace polymers in the region.

Key Vendor Takeaway

Companies namely Saudi Arabia Basic Industries Corporation, Kaman Aerospace Corporation, Hyosung Corporation, Toray Carbon Fibers America, Premium Aerotec, SGL Carbon, Toho Tenax Company Limited, BASF Corporation, Holding Company Composite, Ensinger GmbH, Solvay, HITCO Carbon Composites, Inc., and Mitsubishi Heavy Industries Limited are actively operating in this market.

The global market is highly competitive. Multinational companies of the major economies dominate the global market. Toray and Toho Tenax are some of the well-known companies who supply industry grade polymers to leading aircraft manufacturers are like Boeing and Airbus. Collectively, these companies accounted for over 50% revenue share of the global market.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY APPLICATION

- Aerostructure

- Insulation Components

- Components

- Cabin Interiors

- Satellites

- Equipment

- Propulsion Systems

- Systems & Support

- Construction

MARKET, BY END-USE

- Military Aircrafts

- General Aviation

- Commercial & Freighter Aircrafts

- Rotary Aircrafts

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. AEROSPACE PLASTIC MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Application

2.1.2. Market Snippet by End Use

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. AEROSPACE PLASTIC KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. AEROSPACE PLASTIC INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. AEROSPACE PLASTIC MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. AEROSPACE PLASTIC MARKET – BY APPLICATION

6.1. Overview

6.1.1. Segment Share Analysis, By Application, 2017 & 2025 (%)

6.2. Aerostructure

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Insulation Components

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Components

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5. Cabin Interiors

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.6. Satellites

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.7. Equipment

6.7.1. Overview

6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.8. Propulsion Systems

6.8.1. Overview

6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.9. Systems & Support

6.9.1. Overview

6.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.10. Construction

6.10.1. Overview

6.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. AEROSPACE PLASTIC MARKET – BY END USE

7.1. Overview

7.1.1. Segment Share Analysis, By End Use, 2017 & 2025 (%)

7.2. Military Aircrafts

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. General Aviation

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Commercial & Freighter Aircrafts

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Rotary Aircrafts

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. AEROSPACE PLASTIC MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2017 & 2025 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.2.4. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.2.5. North America Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.3.5. Europe Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

8.3.6. France

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.7. Germany

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.8. Rest of Europe

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

8.4.6. China

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.7. India

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.8. Rest of APAC

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Key Manufacturers in Rest of the World

8.5.3. Rest of the World Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.5.4. Rest of the World Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.5.5. Rest of the World Market Size and Forecast, By End Use, 2014 – 2025 (US$ Million)

8.5.6. Latin America

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.7. Middle East and Africa

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Saudi Arabia Basic Industries Corporation

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Kaman Aerospace Corporation

9.2.1. Company Snapshot

9.2.2. Financial Performance

9.2.3. Product Benchmarking

9.2.4. Strategic Initiatives

9.3. Hyosung Corporation

9.3.1. Company Snapshot

9.3.2. Financial Performance

9.3.3. Product Benchmarking

9.3.4. Strategic Initiatives

9.4. Toray Carbon Fibers America

9.4.1. Company Snapshot

9.4.2. Financial Performance

9.4.3. Product Benchmarking

9.4.4. Strategic Initiatives

9.5. Premium Aerotec

9.5.1. Company Snapshot

9.5.2. Financial Performance

9.5.3. Product Benchmarking

9.5.4. Strategic Initiatives

9.6. SGL Carbon

9.6.1. Company Snapshot

9.6.2. Financial Performance

9.6.3. Product Benchmarking

9.6.4. Strategic Initiatives

9.7. Toho Tenax Company Limited

9.7.1. Company Snapshot

9.7.2. Financial Performance

9.7.3. Product Benchmarking

9.7.4. Strategic Initiatives

9.8. BASF Corporation

9.8.1. Company Snapshot

9.8.2. Financial Performance

9.8.3. Product Benchmarking

9.8.4. Strategic Initiatives

9.9. Holding Company Composite

9.9.1. Company Snapshot

9.9.2. Financial Performance

9.9.3. Product Benchmarking

9.9.4. Strategic Initiatives

9.10. Ensinger GmbH

9.10.1. Company Snapshot

9.10.2. Financial Performance

9.10.3. Product Benchmarking

9.10.4. Strategic Initiatives

9.11. Solvay

9.11.1. Company Snapshot

9.11.2. Financial Performance

9.11.3. Product Benchmarking

9.11.4. Strategic Initiatives

9.12. HITCO Carbon Composites, Inc.

9.12.1. Company Snapshot

9.12.2. Financial Performance

9.12.3. Product Benchmarking

9.12.4. Strategic Initiatives

9.13. Mitsubishi Heavy Industries Limited

9.13.1. Company Snapshot

9.13.2. Financial Performance

9.13.3. Product Benchmarking

9.13.4. Strategic Initiatives

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

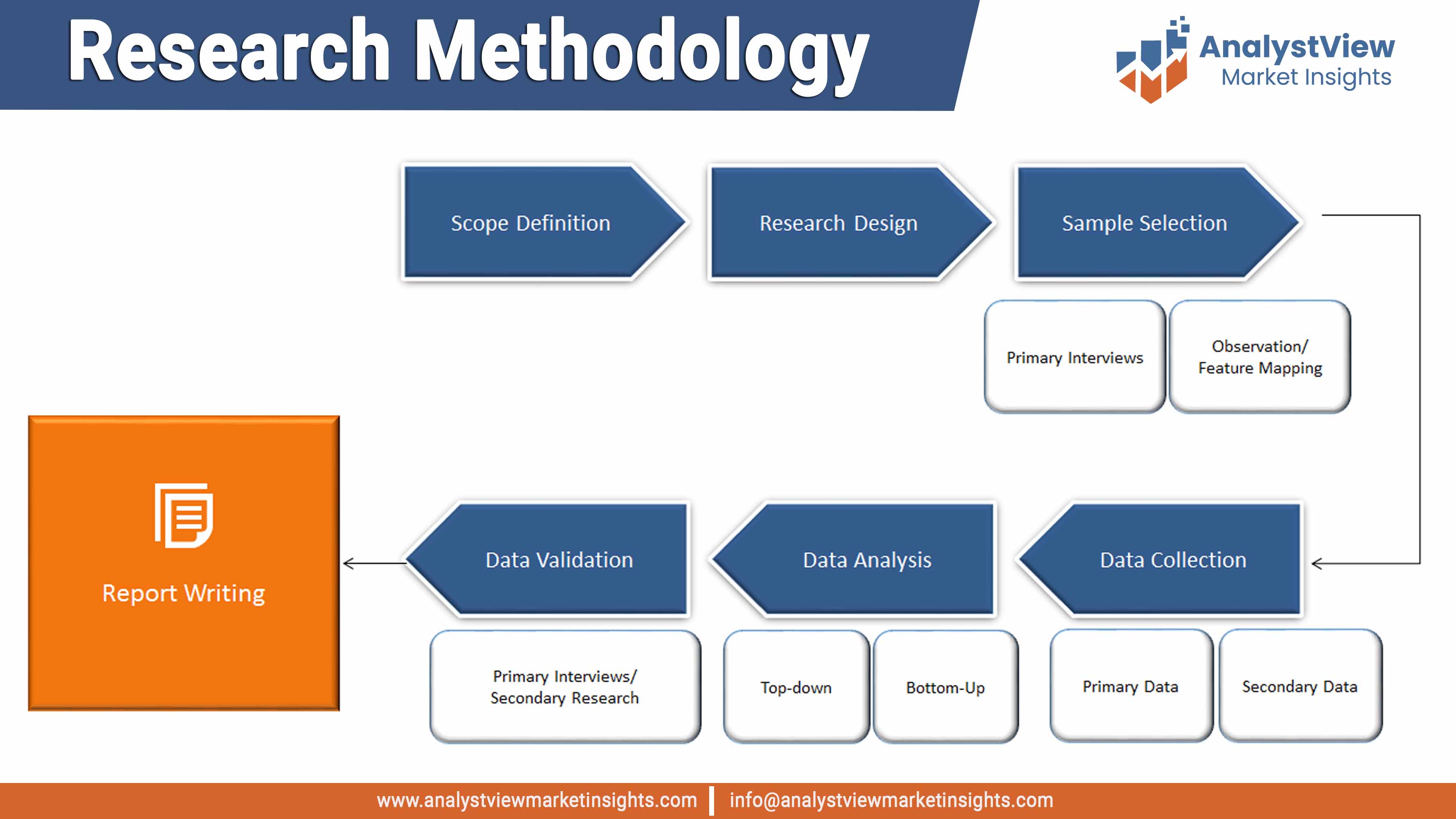

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data Technology

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Aerospace Plastic market: Application snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Aerospace Plastic market, by Application 2014-2025 (USD Million)

TABLE Aerospace Plastic market: End Use snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by End Use

TABLE Global Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Aerospace Plastic market: regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by region

TABLE Global Aerospace Plastic market, by region 2014-2025 (USD Million)

TABLE North America Aerospace Plastic market, by country, 2014-2025 (USD Million)

TABLE North America Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE North America Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE U.S. Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE U.S. Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Canada Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Canada Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Europe Aerospace Plastic market, by country, 2014-2025 (USD Million)

TABLE Europe Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Europe Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Germany Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Germany Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE U.K. Aerospace Plastic market, by Technology, 2014-2025 (USD Million)

TABLE U.K. Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE U.K. Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE U.K. Aerospace Plastic market, by Services, 2014-2025 (USD Million)

TABLE Rest of the Europe Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Rest of the Europe Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Asia Pacific Aerospace Plastic market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Japan Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Japan Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE China Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE China Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Rest of the World Aerospace Plastic market, by country, 2014-2025 (USD Million)

TABLE Rest of the World Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Rest of the World Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Latin America Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Latin America Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

TABLE Middle East and Africa Aerospace Plastic market, by Application, 2014-2025 (USD Million)

TABLE Middle East and Africa Aerospace Plastic market, by End Use, 2014-2025 (USD Million)

List of Figures

FIGURE Aerospace Plastic market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Application segment market share analysis, 2017 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Aerostructure market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Plant Genetic Engineering market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Insulation Components market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Components market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Cabin Interiors market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Satellites market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Equipment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Propulsion Systems market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Systems & Support market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Construction market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE End Use segment market share analysis, 2017 & 2025

FIGURE End Use segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Military Aircrafts market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE General Aviation market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Commercial & Freighter Aircrafts market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rotary Aircrafts market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2017 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Aerospace Plastic market share and leading players, 2018

FIGURE Europe Aerospace Plastic market share and leading players, 2018

FIGURE Asia Pacific Aerospace Plastic market share and leading players, 2018

FIGURE Latin America Aerospace Plastic market share and leading players, 2018

FIGURE Middle East and Africa Aerospace Plastic market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE U.K. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of Asia Pacific market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the World market share analysis by country, 2018

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)