Agrochemicals Market, By Type (Fertilizers (Nitrogenous, Potassic, Phosphatic) and Pesticides (Neonicotinoids, Pyrethroids, Organophosphates and Bio-Pesticides)), By Crop Type and Geography (North America, Europe, Asia Pacific and Rest of the World) Analysis, Share, Trends, Size, & Forecast from 2014 2025

|

Report ID

AV377

|

Published Date

September 2020

|

Pages

143

|

Industry

Bulk Chemicals

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

The Agrochemicals market was valued at USD 218.9 billion by 2017, growing with 4.2% CAGR during the forecast period, 2019-2025

Market Dynamics

Agro-chemicals have been specifically developed and engineered via a biochemical or chemical process to enhance crop productivity & increase soil fertility while ultimately protecting the soil and crops from pests. Agrochemicals such as pesticides, herbicides, fertilizers and bio pesticides are essential for crop protection. They are also used to increase agriculture production in order to meet the growing food requirements of a burgeoning global population.

The agro-chemical market is an important industry owing to high growth in commercial high value crop cultivation to meet the diversified food demand. Growing consumer awareness regarding healthcare and better nutrition, coupled with increasing production of high value agricultural commodities is also likely to provide high return on investment (ROI) in this industry.

Growing demand for high value crops such as cereals and grains, fruits and vegetables, and protected cultivation of crops is also crucial to market growth. Increasing investments in the greenhouse system for agriculture production also provides lucrative opportunities in this industry. These systems provide highly seasonal and high quality crops, which is likely to drive the demand for agrochemicals products such as fertilizers and pesticides.

Technological innovations are also likely to boost agricultural activities, fostering optimal use of limited resources such as water, land and fertilizers. Increasing demand for superior quality agrochemicals to provide nutritive and balanced meals for consumers is also expected to foster industry growth. Decreasing availability of arable land and growing population is driving the overall market. Effective control measures for pests & increasing varieties of agro chemicals is also likely to drive the demand for these chemicals.

Sharing of intellectual property rights and rigorous research, coupled with increasing R&D efforts to develop genetically modified crops, & improve chemical properties is also a driving force for the industry. Increasing cultivation of commodity crops such as sugarcane and oil seeds owing to innovative applications such as fuel, food and other industrial uses could also drive the agro-chemicals market. Innovations such as bio-farming are also expected to positively impact market growth.

Product Takeaway

The global agrochemical market has been segmented on the basis of region and product. The product market has been further divided into fertilizers and pesticides. Major fertilizers include nitrogenous, potassic and phosphatic. Nitrogeneous occupied the largest share in the fertilizers market. Chief pesticides in this segment include organophosphates, pyrethroids, bio-pesticides and neonicotinoides. Phosphatic fertilizers represent a smaller market share but are likely to witness highest growth among all product segments. Organophosphate pesticides are estimated to witness high growth as well, owing to the multi-benefits of chemicals such as glyphosate and chlorpyrifos.

Regional Takeaway

Regional segmentation includes North America, Europe, Cnetral & South America (CSA), Aisa Pacific and Middle East & Africa (MEA). Asia Pacific held the largest market share, owing to the burgeoning population in emerging countries such as China & India and growing agricultural activities to meet food requirements.

Asia pacific dominated the market with a share of around 35%, whereas Europe is expected to emerge as the fastest growing region in the near future. Growing awareness among the farmers regarding technological innovations & improve farming techniques is expected to drive the demand in this region.

Key Vendors Takeaway

Major players such as Israel Chemicals, The Mosaic Co., BASF SE, Yara International ASA and Dow Chemical Limited accounted for over 75% of the worldwide agrochemicals market. Partnerships, agreements, joint collaborations are considered to be the most preferred growth strategies in the global agrochemicals market.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, PRODUCT TAKEAWAY

- Fertilizers

- Nitrogenous

- Potassic

- Phosphatic

- Pesticides

- Neonicotinoids

- Pyrethroids

- Organophosphates

- Bio-Pesticides

MARKET, CROP TYPE TAKEAWAY

- Fruits & Vegetables

- Oilseeds & Pulses

- Cereals & Grains

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. AGROCHEMICALS MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Type

2.1.2. Market Snippet by Crop Type

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. AGROCHEMICALS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. AGROCHEMICALS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. AGROCHEMICALS MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. AGROCHEMICALS MARKET – BY TYPE

6.1. Overview

6.1.1. Segment Share Analysis, By Type, 2017 & 2025 (%)

6.2. Fertilizers

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.2.3. Nitrogenous

6.2.3.1. Overview

6.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.2.4. Potassic

6.2.4.1. Overview

6.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.2.5. Phosphatic

6.2.5.1. Overview

6.2.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3. Pesticides

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3.3. Neonicotinoids

6.3.3.1. Overview

6.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3.4. Pyrethroids

6.3.4.1. Overview

6.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3.5. Organophosphates

6.3.5.1. Overview

6.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3.6. Bio-Pesticides

6.3.6.1. Overview

6.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7. AGROCHEMICALS MARKET – BY CROP TYPE

7.1. Overview

7.1.1. Segment Share Analysis, By Crop Type, 2017 & 2025 (%)

7.2. Fruits & Vegetables

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3. Oilseeds & Pulses

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.4. Cereals & Grains

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.5. Other Crop Types

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8. AGROCHEMICALS MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2017 & 2025 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Billion)

8.2.4. North America Market Size and Forecast, By Type, 2014 – 2025 (US$ Billion)

8.2.5. North America Market Size and Forecast, By Crop Type, 2014 – 2025 (US$ Billion)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Billion)

8.3.4. Europe Market Size and Forecast, By Type, 2014 – 2025 (US$ Billion)

8.3.5. Europe Market Size and Forecast, By Crop Type, 2014 – 2025 (US$ Billion)

8.3.6. France

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.7. Germany

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.8. Rest of Europe

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Billion)

8.4.4. Asia Pacific Market Size and Forecast, By Type, 2014 – 2025 (US$ Billion)

8.4.5. Asia Pacific Market Size and Forecast, By Crop Type, 2014 – 2025 (US$ Billion)

8.4.6. China

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.7. India

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.8. Rest of APAC

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Key Manufacturers in Rest of the World

8.5.3. Rest of the World Market Size and Forecast, By Country, 2014 – 2025 (US$ Billion)

8.5.4. Rest of the World Market Size and Forecast, By Type, 2014 – 2025 (US$ Billion)

8.5.5. Rest of the World Market Size and Forecast, By Crop Type, 2014 – 2025 (US$ Billion)

8.5.6. Latin America

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.7. Middle East and Africa

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

9. KEY VENDOR ANALYSIS

9.1. Yara International ASA

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Israel Chemicals

9.3. Syngenta AG

9.4. The Mosaic Co.

9.5. BASF SE

9.6. Dow Chemical Limited

9.7. Bayer Cropscience AG

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

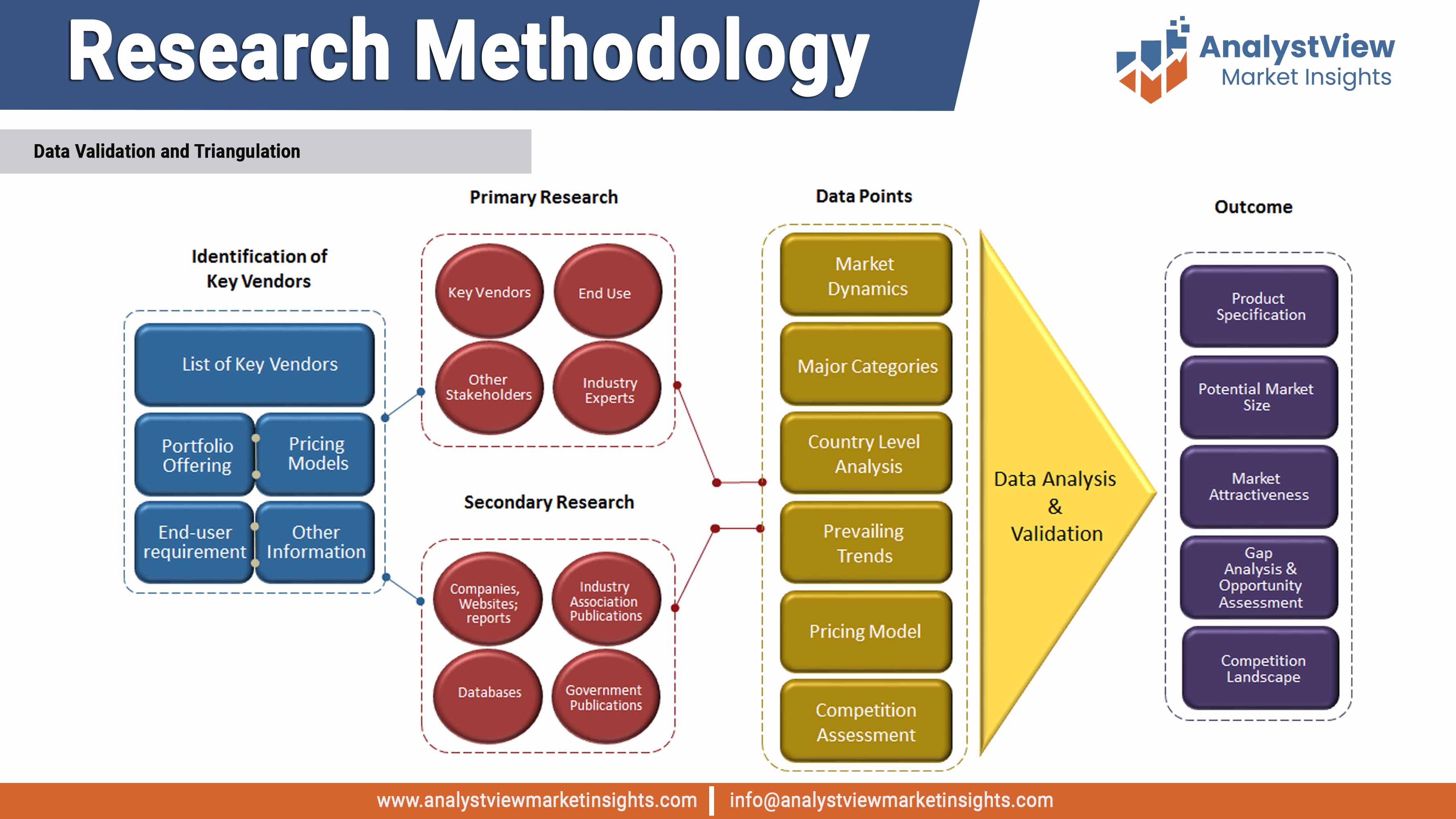

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Agrochemicals market: Type snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Type

TABLE Global Agrochemicals market, by Type 2014-2025 (USD Billion)

TABLE Agrochemicals market: Crop Type snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Crop Type

TABLE Global Agrochemicals market, by Crop Type 2014-2025 (USD Billion)

TABLE Agrochemicals market: regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by region

TABLE Global Agrochemicals market, by region 2014-2025 (USD Billion)

TABLE North America Agrochemicals market, by country, 2014-2025 (USD Billion)

TABLE North America Agrochemicals market, by Type, 2014-2025 (USD Billion)

TABLE North America Agrochemicals market, by Crop Type, 2014-2025 (USD Billion)

TABLE Europe Agrochemicals market, by country, 2014-2025 (USD Billion)

TABLE Europe Agrochemicals market, by Type, 2014-2025 (USD Billion)

TABLE Europe Agrochemicals market, by Crop Type, 2014-2025 (USD Billion)

TABLE Asia Pacific Agrochemicals market, by country, 2014-2025 (USD Billion)

TABLE Asia Pacific Agrochemicals market, by Type, 2014-2025 (USD Billion)

TABLE Rest of the World Agrochemicals market, by country, 2014-2025 (USD Billion)

TABLE Rest of the World Agrochemicals market, by Type, 2014-2025 (USD Billion)

TABLE Rest of the World Agrochemicals market, by Crop Type, 2014-2025 (USD Billion)

List of Figures

FIGURE Agrochemicals market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Type segment market share analysis, 2017 & 2025

FIGURE Type segment market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Fertilizers market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Nitrogenous market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Potassic market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Phosphatic market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Pesticides market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Neonicotinoids market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Pyrethroids market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Organophosphates market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Bio-Pesticides market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Crop Type segment market share analysis, 2017 & 2025

FIGURE Crop Type segment market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Fruits & Vegetables market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Oilseeds & Pulses market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Cereals & Grains market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Regional segment market share analysis, 2017 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE North America Agrochemicals market share and leading players, 2018

FIGURE Europe Agrochemicals market share and leading players, 2018

FIGURE Asia Pacific Agrochemicals market share and leading players, 2018

FIGURE Latin America Agrochemicals market share and leading players, 2018

FIGURE Middle East and Africa Agrochemicals market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Europe market share analysis by country, 2018

FIGURE U.K. market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Rest of Asia Pacific market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Rest of the World market share analysis by country, 2018

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Billion)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS