Business-to-Business (B2B) E-commerce Market, By Deployment Model (Supplier-oriented B2B E-commerce, Buyer-oriented B2B E-commerce, and Intermediary-oriented B2B E-commerce), By Sector (Food and Beverages, Automotive Parts, Apparel and Fashion, Consumer Electronics, and Health and Beauty) and By Geography (NA, EU, APAC, LATAM and MEA) Analysis, Share, Trends, Size, & Forecast From 2020 2026

|

Report ID

AV579

|

Published Date

May 2020

|

Pages

198

|

Industry

Semiconductor and Electronics

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

Business-to-Business (B2B) E-commerce market was valued at USD 1.73 billion by 2019, growing with 19.8% CAGR during the forecast period, 2020-2026

Market Dynamics

E-commerce has become a progressively crucial source of competitive advantages for business-to-business (B2B) companies. B2B E-commerce functions as the process of sale, purchase, and trading of goods and services by means of an online sales portal between businesses. This leads to decreasing transactional costs while offering a wide range of additional services and enhancing operational efficiency. There has been rapid migration of manufacturers and wholesalers from traditional systems to online platforms which is among major factors fuelling the B2B e-commerce market demand. According to a report published by ‘BigCommerce’ (world’s largest cloud ecommerce platform) in July 2017, nearly 41% of B2B retailers have estimated a 25% growth in B2B online sales in next four years. It is also estimated that the companies not making a move into digital commerce are likely to lose its customers and face more struggle to compete in near future.

The use of mobile wallets and mobile apps is on the rise. Payment options form an important aspect of the B2B ecommerce sales process. Till now, POs and checks have been the commonly used payment methods. The emergence of mobile payment applications has simplified e-commerce payment methods. This is creating a positive impact on the market. As a result of above mentioned factors, the global B2B e-commerce market is expected to grow remarkably.

Further, the currently ongoing global pandemic, COVID-19 is projected to significantly impact all the major economic sectors including the global B2B E-commerce market during the forecast period. The report takes into account the impact of the novel COVID-19 pandemic on the Business-to-Business (B2B) E-commerce market and offers a clear assessment of the projected market fluctuations during the forecast period. According to an article published on May 2020 by E-commerce journals, the online sales has witnessed a significant growth along with surging number of online customers. To ensure social distancing and business continuity, the government and retailers are encouraging customers to shop online and creating a digital experience for them. This will further create a shift in customer buying behaviour from legacy methods to online platforms. It is analysed that covid-19 outbreak is foreseen to have a positive impact on promoting adoption of B2B E-commerce among retailers.

Deployment Model Takeaway

Based on the deployment model, the worldwide Business-to-Business (B2B) E-commerce market is categorized into Supplier-oriented B2B E-commerce, Buyer-oriented B2B E-commerce, and Intermediary-oriented B2B E-commerce. Among which, the buyer-oriented category accounted for the significant revenue share in 2019. In buyer-oriented model, there are several buyers and only few suppliers in which supplier provides a common marketplace. This model is used by both businesses as well as individual customers. A good example of this model implementation is Cisco. The company owns an online marketplace called Cisco Connection Online which functions based on buyer-oriented B2B E-commerce model.

On contrary, supplier-oriented model is anticipated to grow with promising growth rate during the study period. In a supplier-oriented model, there are only few buyers and several suppliers. The buyer having his own online marketplace functions to invite suppliers and manufacturers to display their products. General Electric is an example of incorporating this model perfectly into its GE’s electronic bidding site. Further, in case of intermediary model, a third party/ company runs a marketplace where business sellers and buyers meet to do business with each other.

Sector Takeaway

Depending upon the sector, the industry is segmented into the following categories i.e., automotive parts, apparel and fashion, consumer electronics, food and beverages, and health and beauty. Currently, various sectors are adopting e-commerce platform so as to gain a competitive advantage by minimizing time and resources spent through automation of online and offline transactions, resulting in improved operational efficiency.

The study revealed that the apparel and fashion industry accounted for the significant revenue share in 2019. In Apparel and Fashion sector, majority of B2B customer prefer to make online purchase due to user-friendly platform and display of real time inventory. B2B E-commerce is used by automotive manufacturers to buy raw materials several suppliers at a time. Reducing transactional costs has driven major healthcare providers to adopt B2B E-commerce. Similarly, online availability of consumer electronics at a reasonable pricing is favouring market growth in this sector.

Regional Takeaway

Regionally, Asia Pacific and Europe are expected to witness surge in demand for B2B e-commerce adoption, mainly due to focus on improved business mobility, infrastructure, and offering improved customer services. In major European countries such as Germany, France and UK, B2B e-commerce market is estimated to witness rise in demand over the forecast period, which can be attributed to shifting focus towards smart personalization of products and services by leveraging machine learning into cloud. In North America, leading companies such as Amazon focus more on providing improved user experience and better customer relationships as part of their growth strategy.

Key Vendor Takeaway

Some of the key players that are actively responsible for the growth of this industry are HCL Technologies, Axway, SAP SE (Hybris Software), Alibaba.com, Oracle Corporation, Amazon, Inc., IBM Corporation, Phoenix Biz Solutions, Techdinamics Inc., and Netalogue Technologies plc.

In March, 2018, Boardriders Inc., a global sport and apparel equipment manufacturer partnered with Plumriver’s Elastic Suite, a B2B digital merchandising platform. This partnership is aimed to gain improved levels of ecommerce efficiency by means of enhancing the product procurement cycle with retailers. Further, leading online retailers such as Amazon Inc. has initiated a transition from a developing E-commerce channel experimentation to full omnichannel sales approaches for improved dealing with goods and services.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET KEY PLAYERS

- HCL Technologies

- com

- SAP SE (Hybris Software)

- Amazon, Inc.

- IBM Corporation

- Oracle Corporation

- Axway

- Phoenix Biz Solutions

- Techdinamics Inc.

- Netalogue Technologies plc

BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET BY DEPLOYMENT MODEL

- Supplier-oriented B2B E-commerce

- Buyer-oriented B2B E-commerce

- Intermediary-oriented B2B E-commerce

BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET, BY SECTOR

- Consumer Electronics

- Automotive Parts

- Health and Beauty

- Food and Beverages

- Apparel and Fashion

- Others

BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

REPORT HIGHLIGHT

Business-to-Business (B2B) E-commerce market was valued at USD 1.73 billion by 2019, growing with 19.8% CAGR during the forecast period, 2020-2026

Market Dynamics

E-commerce has become a progressively crucial source of competitive advantages for business-to-business (B2B) companies. B2B E-commerce functions as the process of sale, purchase, and trading of goods and services by means of an online sales portal between businesses. This leads to decreasing transactional costs while offering a wide range of additional services and enhancing operational efficiency. There has been rapid migration of manufacturers and wholesalers from traditional systems to online platforms which is among major factors fuelling the B2B e-commerce market demand. According to a report published by ‘BigCommerce’ (world’s largest cloud ecommerce platform) in July 2017, nearly 41% of B2B retailers have estimated a 25% growth in B2B online sales in next four years. It is also estimated that the companies not making a move into digital commerce are likely to lose its customers and face more struggle to compete in near future.

The use of mobile wallets and mobile apps is on the rise. Payment options form an important aspect of the B2B ecommerce sales process. Till now, POs and checks have been the commonly used payment methods. The emergence of mobile payment applications has simplified e-commerce payment methods. This is creating a positive impact on the market. As a result of above mentioned factors, the global B2B e-commerce market is expected to grow remarkably.

Further, the currently ongoing global pandemic, COVID-19 is projected to significantly impact all the major economic sectors including the global B2B E-commerce market during the forecast period. The report takes into account the impact of the novel COVID-19 pandemic on the Business-to-Business (B2B) E-commerce market and offers a clear assessment of the projected market fluctuations during the forecast period. According to an article published on May 2020 by E-commerce journals, the online sales has witnessed a significant growth along with surging number of online customers. To ensure social distancing and business continuity, the government and retailers are encouraging customers to shop online and creating a digital experience for them. This will further create a shift in customer buying behaviour from legacy methods to online platforms. It is analysed that covid-19 outbreak is foreseen to have a positive impact on promoting adoption of B2B E-commerce among retailers.

Deployment Model Takeaway

Based on the deployment model, the worldwide Business-to-Business (B2B) E-commerce market is categorized into Supplier-oriented B2B E-commerce, Buyer-oriented B2B E-commerce, and Intermediary-oriented B2B E-commerce. Among which, the buyer-oriented category accounted for the significant revenue share in 2019. In buyer-oriented model, there are several buyers and only few suppliers in which supplier provides a common marketplace. This model is used by both businesses as well as individual customers. A good example of this model implementation is Cisco. The company owns an online marketplace called Cisco Connection Online which functions based on buyer-oriented B2B E-commerce model.

On contrary, supplier-oriented model is anticipated to grow with promising growth rate during the study period. In a supplier-oriented model, there are only few buyers and several suppliers. The buyer having his own online marketplace functions to invite suppliers and manufacturers to display their products. General Electric is an example of incorporating this model perfectly into its GE’s electronic bidding site. Further, in case of intermediary model, a third party/ company runs a marketplace where business sellers and buyers meet to do business with each other.

Sector Takeaway

Depending upon the sector, the industry is segmented into the following categories i.e., automotive parts, apparel and fashion, consumer electronics, food and beverages, and health and beauty. Currently, various sectors are adopting e-commerce platform so as to gain a competitive advantage by minimizing time and resources spent through automation of online and offline transactions, resulting in improved operational efficiency.

The study revealed that the apparel and fashion industry accounted for the significant revenue share in 2019. In Apparel and Fashion sector, majority of B2B customer prefer to make online purchase due to user-friendly platform and display of real time inventory. B2B E-commerce is used by automotive manufacturers to buy raw materials several suppliers at a time. Reducing transactional costs has driven major healthcare providers to adopt B2B E-commerce. Similarly, online availability of consumer electronics at a reasonable pricing is favouring market growth in this sector.

Regional Takeaway

Regionally, Asia Pacific and Europe are expected to witness surge in demand for B2B e-commerce adoption, mainly due to focus on improved business mobility, infrastructure, and offering improved customer services. In major European countries such as Germany, France and UK, B2B e-commerce market is estimated to witness rise in demand over the forecast period, which can be attributed to shifting focus towards smart personalization of products and services by leveraging machine learning into cloud. In North America, leading companies such as Amazon focus more on providing improved user experience and better customer relationships as part of their growth strategy.

Key Vendor Takeaway

Some of the key players that are actively responsible for the growth of this industry are HCL Technologies, Axway, SAP SE (Hybris Software), Alibaba.com, Oracle Corporation, Amazon, Inc., IBM Corporation, Phoenix Biz Solutions, Techdinamics Inc., and Netalogue Technologies plc.

In March, 2018, Boardriders Inc., a global sport and apparel equipment manufacturer partnered with Plumriver’s Elastic Suite, a B2B digital merchandising platform. This partnership is aimed to gain improved levels of ecommerce efficiency by means of enhancing the product procurement cycle with retailers. Further, leading online retailers such as Amazon Inc. has initiated a transition from a developing E-commerce channel experimentation to full omnichannel sales approaches for improved dealing with goods and services.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET KEY PLAYERS

- HCL Technologies

- com

- SAP SE (Hybris Software)

- Amazon, Inc.

- IBM Corporation

- Oracle Corporation

- Axway

- Phoenix Biz Solutions

- Techdinamics Inc.

- Netalogue Technologies plc

BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET BY DEPLOYMENT MODEL

- Supplier-oriented B2B E-commerce

- Buyer-oriented B2B E-commerce

- Intermediary-oriented B2B E-commerce

BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET, BY SECTOR

- Consumer Electronics

- Automotive Parts

- Health and Beauty

- Food and Beverages

- Apparel and Fashion

- Others

BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Deployment Model

2.1.2. Market Snippet by Sector

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. BUSINESS-TO-BUSINESS (B2B) E-COMMERCE KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. BUSINESS-TO-BUSINESS (B2B) E-COMMERCE INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

4.5. COVID-19 Impact Analysis

4.5.1. Pre-COVID-19 Impact Analysis

4.5.2. Post-COVID-19 Impact Analysis

5. BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key Manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET – BY DEPLOYMENT MODEL

6.1. Overview

6.1.1. Segment Share Analysis, By Deployment Model, 2019 & 2026 (%)

6.2. Supplier-oriented B2B E-commerce

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3. Buyer-oriented B2B E-commerce

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4. Intermediary-oriented B2B E-commerce

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7. BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET – BY SECTOR

7.1. Overview

7.1.1. Segment Share Analysis, By Sector, 2019 & 2026 (%)

7.2. Food and Beverages

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3. Health and Beauty

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4. Apparel and Fashion

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.5. Automotive Parts

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.6. Consumer Electronics

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.7. Others

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8. BUSINESS-TO-BUSINESS (B2B) E-COMMERCE MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2019 & 2026 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.2.4. North America Market Size and Forecast, By Deployment Model, 2015 – 2026 (US$ Million)

8.2.5. North America Market Size and Forecast, By Sector, 2015 – 2026 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Deployment Model, 2015 – 2026 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Sector, 2015 – 2026 (US$ Million)

8.3.6. Germany

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.7. Italy

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.8. United Kingdom

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.9. France

8.3.9.1. Overview

8.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.10. Rest of Europe

8.3.10.1. Overview

8.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Deployment Model, 2015 – 2026 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Sector, 2015 – 2026 (US$ Million)

8.4.6. India

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.7. China

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.8. Japan

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.9. South Korea

8.4.9.1. Overview

8.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.10. Rest of APAC

8.4.10.1. Overview

8.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5. Latin America

8.5.1. Overview

8.5.2. Key Manufacturers in Latin America

8.5.3. Latin America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.5.4. Latin America Market Size and Forecast, By Deployment Model, 2015 – 2026 (US$ Million)

8.5.5. Latin America Market Size and Forecast, By Sector, 2015 – 2026 (US$ Million)

8.5.6. Brazil

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.7. Mexico

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.8. Argentina

8.5.8.1. Overview

8.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.9. Rest of LATAM

8.5.9.1. Overview

8.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6. Middle East and Africa

8.6.1. Overview

8.6.2. Key Manufacturers in Middle East and Africa

8.6.3. Middle East and Africa Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.6.4. Middle East and Africa Market Size and Forecast, By Deployment Model, 2015 – 2026 (US$ Million)

8.6.5. Middle East and Africa Market Size and Forecast, By Sector, 2015 – 2026 (US$ Million)

8.6.6. Saudi Arabia

8.6.6.1. Overview

8.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6.7. United Arab Emirates

8.6.7.1. Overview

8.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Alibaba

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Oracle

9.3. Phoenix Biz Solutions

9.4. Amazon

9.5. Axway

9.6. HCL

9.7. Hybris Software

9.8. IBM

9.9. Netalogue Technologies plc

9.10. Techdinamics

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

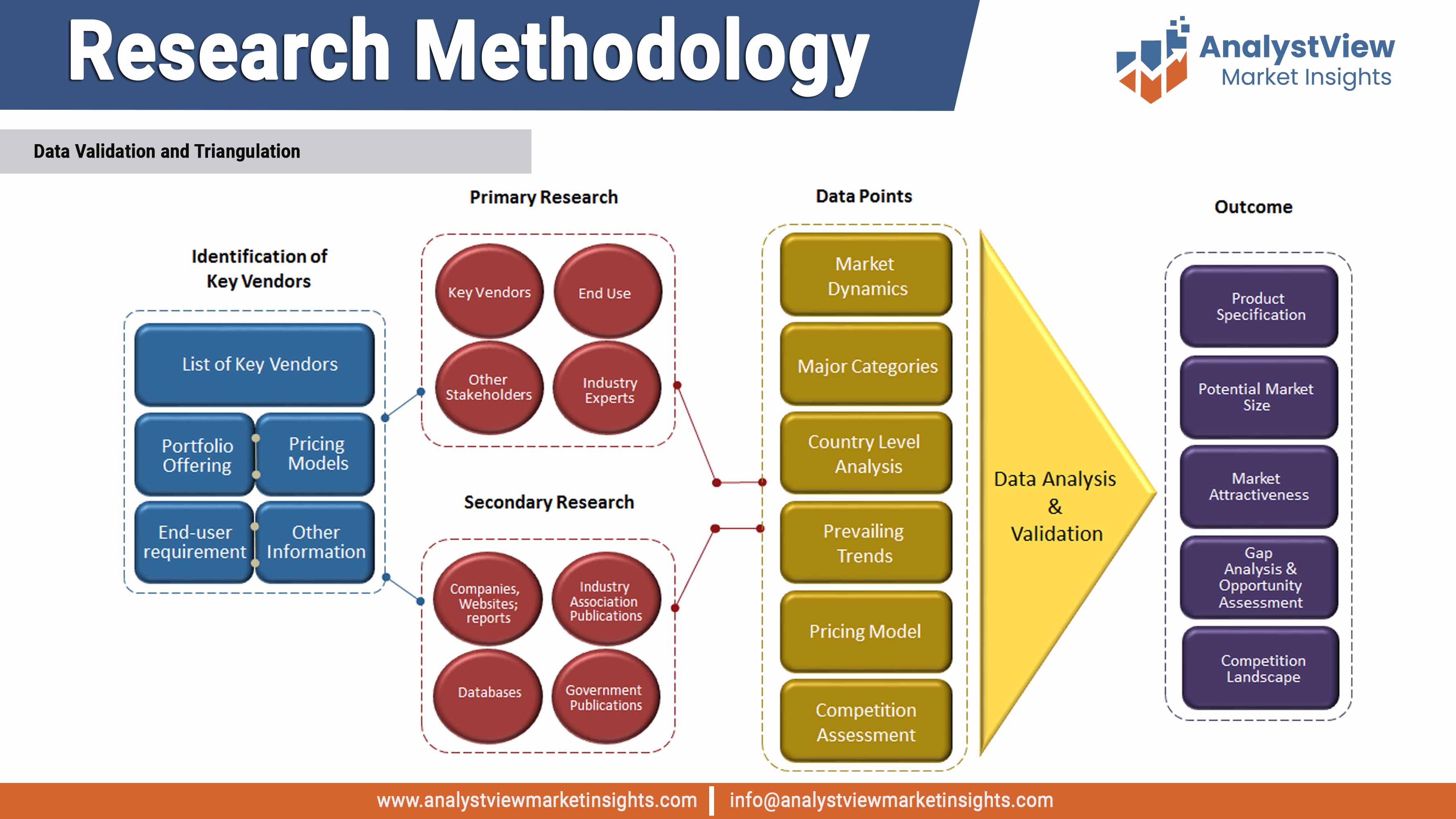

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Business-to-Business (B2B) E-commerce Market: Deployment Model Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Deployment Model

TABLE Global Business-to-Business (B2B) E-commerce Market, by Deployment Model 2015-2026 (USD Million)

TABLE Business-to-Business (B2B) E-commerce Market: Sector Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Sector

TABLE Global Business-to-Business (B2B) E-commerce Market, by Sector 2015-2026 (USD Million)

TABLE Business-to-Business (B2B) E-commerce Market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Business-to-Business (B2B) E-commerce Market, by Region 2015-2026 (USD Million)

TABLE North America Business-to-Business (B2B) E-commerce Market, by Country, 2015-2026 (USD Million)

TABLE North America Business-to-Business (B2B) E-commerce Market, by Deployment Model, 2015-2026 (USD Million)

TABLE North America Business-to-Business (B2B) E-commerce Market, by Sector, 2015-2026 (USD Million)

TABLE Europe Business-to-Business (B2B) E-commerce Market, by Country, 2015-2026 (USD Million)

TABLE Europe Business-to-Business (B2B) E-commerce Market, by Deployment Model, 2015-2026 (USD Million)

TABLE Europe Business-to-Business (B2B) E-commerce Market, by Sector, 2015-2026 (USD Million)

TABLE Asia Pacific Business-to-Business (B2B) E-commerce Market, by Country, 2015-2026 (USD Million)

TABLE Asia Pacific Business-to-Business (B2B) E-commerce Market, by Deployment Model, 2015-2026 (USD Million)

TABLE Asia Pacific Business-to-Business (B2B) E-commerce Market, by Sector, 2015-2026 (USD Million)

TABLE Latin America Business-to-Business (B2B) E-commerce Market, by Country, 2015-2026 (USD Million)

TABLE Latin America Business-to-Business (B2B) E-commerce Market, by Deployment Model, 2015-2026 (USD Million)

TABLE Latin America Business-to-Business (B2B) E-commerce Market, by Sector, 2015-2026 (USD Million)

TABLE Middle East and Africa Business-to-Business (B2B) E-commerce Market, by Country, 2015-2026 (USD Million)

TABLE Middle East and Africa Business-to-Business (B2B) E-commerce Market, by Deployment Model, 2015-2026 (USD Million)

TABLE Middle East and Africa Business-to-Business (B2B) E-commerce Market, by Sector, 2015-2026 (USD Million)

List of Figures

FIGURE Business-to-Business (B2B) E-commerce Market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE COVID-19 Impact Analysis

FIGURE Pre & Post COVID-19 Impact Comparision Study

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Deployment Model segment market share analysis, 2019 & 2026

FIGURE Deployment Model segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Buyer-oriented B2B E-commerce market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Supplier-oriented B2B E-commerce market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Intermediary-oriented B2B E-commerce market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Sector segment market share analysis, 2019 & 2026

FIGURE Sector segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Apparel and Fashion market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Automotive Parts market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Food and Beverages market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Health and Beauty market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Consumer Electronics market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Others market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Regional segment market share analysis, 2019 & 2026

FIGURE Regional segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE North America Business-to-Business (B2B) E-commerce Market share and leading players, 2018

FIGURE Europe Business-to-Business (B2B) E-commerce Market share and leading players, 2018

FIGURE Asia Pacific Business-to-Business (B2B) E-commerce Market share and leading players, 2018

FIGURE Latin America Business-to-Business (B2B) E-commerce Market share and leading players, 2018

FIGURE Middle East and Africa Business-to-Business (B2B) E-commerce Market share and leading players, 2018

FIGURE North America Business-to-Business (B2B) E-commerce market share analysis by country, 2018

FIGURE U.S. Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Canada Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Europe Business-to-Business (B2B) E-commerce market share analysis by country, 2018

FIGURE Germany Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Spain Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Italy Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE UK Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE FranceBusiness-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of the Europe Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Asia Pacific Business-to-Business (B2B) E-commerce market share analysis by country, 2018

FIGURE India Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE China Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Japan Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE South Korea Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Singapore Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of APACBusiness-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin AmericaBusiness-to-Business (B2B) E-commerce market share analysis by country, 2018

FIGURE BrazilBusiness-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Mexico Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Argentina Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of LATAM Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Business-to-Business (B2B) E-commerce market share analysis by country, 2018

FIGURE Saudi Arabia Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE United Arab Emirates Business-to-Business (B2B) E-commerce market size, forecast and trend analysis, 2015 to 2026 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS