Electronic Data Capture (EDC) Market, By Component (Software, and Services), by Delivery Mode (Web hosted, Licensed enterprise, and Cloud Based), by Clinical Trials (Phase I, II, III, and Phase IV), by End Use (Hospitals, Research Organizations, Pharma & Biotech Organizations and others) And Geography (North America, Europe, Asia Pacific, And Rest Of The World) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The Electronic data capture (EDC) market is estimated to represent a global market of USD 348.5 million by 2016 with growth rate of 12.8%.

Market Dynamics

Electronic data capture (EDC) system is web-based software that stores participant data collected in clinical studies. Traditionally, before being transcribed into the system, clinical data was recorded on paper documents and then saved in an electronic case report form (eCRF). EDC systems have been used to carry out both simple and complex trials in different phases of clinical research. Clinical studies has become more complex. Companies involved in clinical research require to do more in less stipulated time period. Further, budget, compliance and accuracy also affect to the quality and speed of the clinical process. Considering all these factors, many clinical research organizations have realized the advantage of electronic data capture technique. Research organizations are increasingly adopting new techniques of data capture to support complex clinical studies. Electronic data capture (EDC) has become one of the preferred technique of managing clinical trial data which is expected to provide healthy platform for the market growth over the forecast period.

Advancement in technologies is considered to be the most important driving factor for the growth of EDC market. Large number of vendors are constantly engaged in developing new EDC techniques to keep up with the changes in industry. For instance, in March 2017, PAREXEL International Corporation launched Patient Sensor Solution, which helps in capturing, transmitting, storing and visualizing clinical trial information. This technique enables an end to end technology and service solution which facilitate remote collection of subject data through medical devices. Such introduction would in turn help the market to grow at rapid pace, hence drives the market growth. However, lack of skilled professional is expected to hamper the market growth to some extent. Also, lack of awareness levels in developing countries coupled with lack of cyber security laws which may lead to information leak, hampering the market growth.

Component Takeaways

The market is studies in term of component, delivery mode, clinical trials, and end-use. Component segment is divided into Software, and Services. Services for the EDC systems held the largest market share as of 2016, owing to the availability of a large number of Contract Research Organizations (CROs) offering the eClinical solutions. Strict regulatory scenario to conduct clinical studies have made many end users to adopt novel techniques to meet complex regulatory requirements, which is anticipated to contribute toward the growing demand over the forecast period. Delivery Mode is categorized as Web hosted, Licensed enterprise, and Cloud Based. Among which, web hosted is largest revenue generating segment.

Clinical Trials Takeaways

In terms of clinical trials, the market is divided into Phase I, II, III, and Phase IV. End-use segment is bifurcated as Hospitals, Research Organizations, Pharma & Biotech Organizations and others. In 2016, Clinical phase III held the significant share owing to high need for clinical data management software in order to curtail the overall cost and improve process efficiency. On the other hand, phase I is projected to grow at a decent growth rate as a consequence of high significance of this stage to predict the future outcomes and eliminate drug candidates, possessing low success and probability of clinical trials.

Regional Takeaways

Regionally, the market is categorized as North America, Europe, Asia Pacific and Rest of the World. Developed regions such as North America and Europe captured largest share of the global revenue. Advancement in technologies coupled with favourable government initiatives to new drug development supported the growth. . For instance, European government has conducted European Childhood Obesity Project using Electronic Data Capture (EDC) for clinical trials in order to minimize the need for after-trial data checks.

Developing regions such as Asia Pacific, and Latin America exhibits strong potential for the EDC market. Increasing number of clinical studies coupled with technological advancement have stimulated the demand for EDC techniques in these regions. India and China has become an attractive destination among multinational companies to conduct clinical trials. This is because of its lower unit cost, availability of large patient pool for clinical trials, and government supports. According to the Institutes for Studies in Industrial Development (ISID), the global share of clinical studies in India grew from 0.9% (2008) to 5% (2013). The ration is projected to increase at rapid pace in countries such as India, and China, as mentioned by the ISID.

Key Vendor Takeaways

Companies such as Oracle Corporation, Medidata Solutions Inc., Parexel International Corporation and BioClinica. Competition among key companies is expected to remain at higher level over the forecast period. Companies are adopting strategies such as entering into strategic alliances, product differentiation and expansion of product portfolio in an attempt to capture larger share of the market. Introduction of new techniques is considered to be one of the strategy. For instance, in June 2015, Merge eClinical introduced Study Connect, a new mobile app that allows eClinicalOS users the facility of executing a wide array of clinical trial management from their iOS-based mobile devices. Such types of initiatives would in turn provide healthy platform for the market growth.

The market size and forecast for each segment has been provided for the period 2014 to 2025, considering 2015 as the base year. The report also provides the compounded annual growth rate (% CAGR) for the forecast period 2016 to 2025 for every reported segment.

The years considered for the study are:

- Historical Year – 2014 & 2015

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, And Suppliers

- Manufacturers

- Hospitals

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY COMPONENT

- Software

- Services

MARKET, BY DELIVERY MODE

- Web hosted

- Licensed Enterprise

- Cloud Based

MARKET, BY CLINICAL TRIALS

- Phase I

- Phase II

- Phase III

- Phase IV

MARKET, BY END USE

- Hospitals

- Research Organizations

- Pharma & Biotech Organizations

- Others

MARKET, BY REGION

- North America

- Europe

- Asia Pacific

- Rest of the World

MARKET, BY COUNTRY

- Further Breakdown of The North America Market

- U.S.

- Canada

- Further Breakdown of The Europe Market

- Germany

- France

- Rest of Europe

- Further Breakdown of The APAC Market

- India

- China

- Rest of APAC

- Further Breakdown of The Rest of the World Market

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. ELECTRONIC DATA CAPTURE MARKET OVERVIEW

1.1. Study Scope

1.2. Base Year

1.3. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. ELECTRONIC DATA CAPTURE KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. ELECTRONIC DATA CAPTURE INDUSTRY STUDY

4.1. Company Activity Analysis

4.2. Regulatory Framework Analysis

4.3. Market Attractiveness Analysis

4.4. Value Chain Analysis

5. ELECTRONIC DATA CAPTURE MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

6. ELECTRONIC DATA CAPTURE MARKET – BY COMPONENT:

6.1. Overview

6.2. Software

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Services

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. ELECTRONIC DATA CAPTURE MARKET – BY DELIVERY MODE:

7.1. Overview

7.2. Web hosted

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Licensed Enterprise

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Cloud Based

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. ELECTRONIC DATA CAPTURE MARKET – BY CLINICAL TRIALS:

8.1. Overview

8.2. Phase I

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Phase II

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Phase III

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Phase IV

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. ELECTRONIC DATA CAPTURE MARKET – BY END USE:

9.1. Overview

9.2. Hospitals

9.2.1. Overview

9.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3. Research Organizations

9.3.1. Overview

9.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4. Pharma & Biotech Organizations

9.4.1. Overview

9.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5. Others

9.5.1. Overview

9.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10. ELECTRONIC DATA CAPTURE MARKET– BY GEOGRAPHY

10.1. Introduction

10.2. North America

10.2.1. Overview

10.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.2.3. U.S.

10.2.3.1. Overview

10.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.2.4. Canada

10.2.4.1. Overview

10.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3. Europe

10.3.1. Overview

10.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.3. France

10.3.3.1. Overview

10.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.4. Germany

10.3.4.1. Overview

10.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.5. Rest of Europe

10.3.5.1. Overview

10.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4. Asia Pacific (APAC)

10.4.1. Overview

10.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.3. China

10.4.3.1. Overview

10.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.4. India

10.4.4.1. Overview

10.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.5. Rest of APAC

10.4.5.1. Overview

10.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5. Rest of the World

10.5.1. Overview

10.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5.3. Latin America

10.5.3.1. Overview

10.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5.4. Middle East and Africa

10.5.4.1. Overview

10.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11. KEY VENDOR ANALYSIS

11.1. Medidata Solutions Inc.

11.1.1. Company Overview

11.1.2. SWOT Analysis

11.1.3. Key Developments

11.2. Oracle Corporation

11.2.1. Company Overview

11.2.2. SWOT Analysis

11.2.3. Key Developments

11.3. Parexel International Corporation

11.3.1. Company Overview

11.3.2. SWOT Analysis

11.3.3. Key Developments

11.4. BioClinica

11.4.1. Company Overview

11.4.2. SWOT Analysis

11.4.3. Key Developments

12. 360 DEGREE ANALYSTVIEW

13. APPENDIX

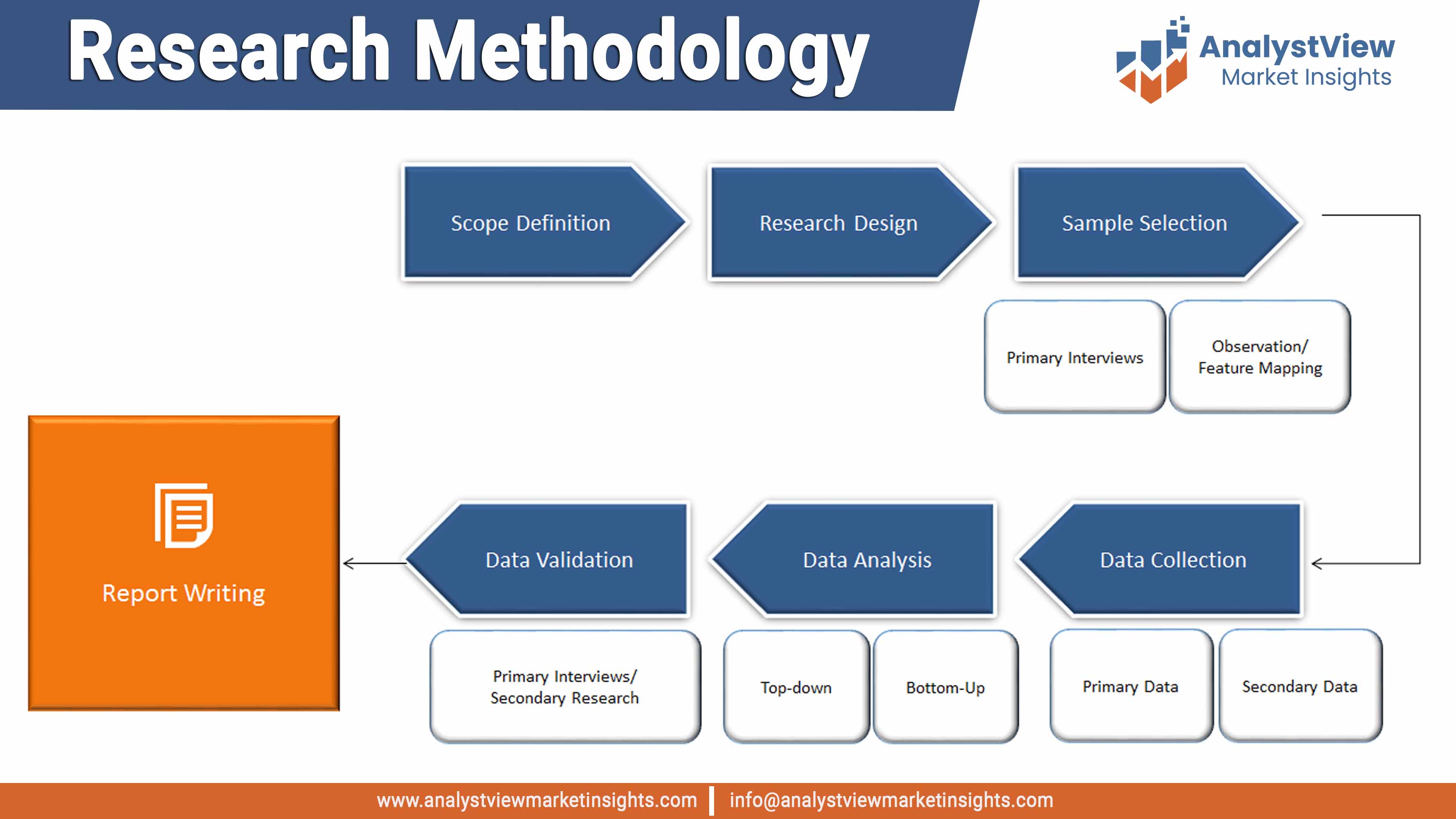

13.1. Research Methodology

13.2. Abbreviations

13.3. Disclaimer

13.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PESTLE Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global Electronic Data Capture Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

Table 10 Electronic Data Capture Market, by Component, 2014 – 2025 (USD Million)

Table 11 Electronic Data Capture Market, by Delivery Mode, 2014 – 2025 (USD Million)

Table 12 Electronic Data Capture Market, by Clinical Trials, 2014 – 2025 (USD Million)

Table 13 Electronic Data Capture Market, by End Use, 2014 – 2025 (USD Million)

Table 14 Electronic Data Capture Market, by Geography, 2014 – 2025 (USD Million)

Table 15 North America Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 16 U.S. Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 17 Canada Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 18 Europe Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 19 France Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 20 Germany Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 21 Asia Pacific Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 22 China Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 23 India Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 24 Latin America Electronic Data Capture Market, 2014 – 2025 (USD Million)

Table 25 MEA Electronic Data Capture Market, 2014 – 2025 (USD Million)

List of Figures

Figure 1 Research Methodology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 Value Chain Analysis Analysis

Figure 6 Electronic Data Capture Market, by Component, 2014 – 2025 (USD Million)

Figure 7 Electronic Data Capture Market, by Delivery Type, 2014 – 2025 (USD Million)

Figure 8 Electronic Data Capture Market, by Clinical Trials, 2014 – 2025 (USD Million)

Figure 9 Electronic Data Capture Market, by End Use, 2014 – 2025 (USD Million)

Figure 10 Electronic Data Capture Market, by Geography, 2014 – 2025 (USD Million)