FPSO Vessel Market Report, By Propulsion (Self-propelled, Double-hull, Towed; Hull Type Single-hull) By Application, By Type and by Operator and Geography (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) Analysis, Share, Trends, Size, & Forecast from 2019 2025

|

Report ID

AV417

|

Published Date

October 2020

|

Pages

155

|

Industry

Bulk Chemicals

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

FPSO Vessel Market was valued at USD 6.93 billion by 2018, growing with 12.9% CAGR during the forecast period, 2019-2025.

Market Dynamics

Floating Production Storage and Off-loading (FPSO) vessel is used in the oil & gas industry as an alternative to fixed or semi-submersible production platforms. It is used to store and process oil and other hydrocarbons gathered offshore. FPSO is an abbreviation for floating, production, storage and offloading. This service is projected to witness a significant demand on account of continuous expansion in the offshore oil sector. The market is expected to show impressive growth with approximate CAGR of over 12%.

An FPSO is a vessel designed to float on water and is used during the offshore crude extraction process by the oil and gas industry. These vessels are used for the production and processing of extracted hydrocarbons. They have inbuilt facilities for oil storage before it is offloaded onto a tanker or transported through a pipeline. Oil exploration in sea beds started in the 1940’s and all oil platforms sat on the seabed. As the exploration went deep in oceans, there was a need of a floating production system. The first FPSO was used in the year 1977 and as of 2015, there are more than 300 vessels in operation.

Oil produced by the offshore platforms are shipped to the inland terminal with the help of a pipeline or a tanker. However, when the extraction is in deep waters, laying pipes is a costly affair. Depletion of oil reserves requires the shift in oil platforms which result in the dismantling of existing laid pipes. Oil tankers require a storage tank which is able to accumulate oil so that the tank is not constantly occupied.

Pipelines installed for minor oil fields which are expected to deplete in few years is a sunk cost and does not explain the huge expense. FPSO eradicate the necessity to install pipes for carrying the extract towards the mainland terminal. Moreover, the same vessel can be used again at another site once its present field is depleted. This durability characteristic which is superior to a fixed extraction platform drives the overall market demand.

High costs involved in the building of these vessels is a major restraint expected to pull the market down. This industry is very capital intensive and constructing a new FPSO costs approximately USD 3 billion. Trends have shown that customers and the manufacturers enter into a contract for payment on an instalment basis. Therefore, organizations need to efficiently utilize their liquid cash reserves to avoid the shortage of funds. In the recent years, the oil extraction companies have shown interest in upgrading their existing platforms into floating units. Such initiatives provide great opportunities to the market growth in near future.

Growing concerns over depleting petroleum reserves over the land have resulted in increased level of exploration in deep oceans. Recently, companies including Petronas, ExxonMobil, Shell, and Talisman are making initiatives in offshore extraction activities which in turn is expected to provide bright prospects for overall industry growth.

Segment Takeaway

Global FPSO is segmented based on the task undertaken by the vessel. An FPSO vessel floats on the seabed and supports production, storage and offloading while FSO container is capable of floating, storage and offloading. An FDPSO does all the activities of FPSO along with drilling. FSRU stands for floating and storage regasification unit. These vessels deal with transportation of natural gas towards the mainland terminal.

Regional Takeaway

Asia Pacific witnessed the highest demand and is expected to continue its dominance over the forecast period owing to the extensive exploration in the Indian Ocean. The significant presence of production operators in Malaysia, India, Indonesia and China is expected to drive the regional demand in near future.

Major clients operating in Asia Pacific region are Petronas, ONGC, Premier Oil, Woodside Petroleum, Talisman and Conoco Philips. Regional demand was followed by Europe on account of high reserves in the North Sea. Norway and the Great Britain are the major countries contributing to the regional demand. British Petroleum, Talisman Energy, and Teekay Petrojarl are the major customers operating in Europe.

South America has shown a tremendous growth in floating oil exploration. Emerging economies including Brazil and Venezuela has shown exponential growth in offshore production. The gulf of Paria, Lake Maracaibo and the Gulf of Venezuela are rich in natural resources which have boosted the FPSO market in Venezuela. Brazil, on the other hand, has been undertaking significant petroleum extraction in the Atlantic Ocean.

North America and Africa is expected to witness a steady growth owing to new reserves found in the Pacific Ocean. Countries in Africa which include Nigeria and Ivory Coast are the potential African markets.

Key Vendors Takeaway

Market players are focusing on collaborations and partnerships across their value chain in order to reduce costs and achieve economies of scale. In the recent years, the industry participants are facing hard times on account of fall in oil prices in the past years. The prices are anticipated to recover in 2018 which is expected to positively impact the market revenues

Key players operating in the container manufacturing are Aker Solution, Modec, BW offshore, Bumi Armada Berhad, Hyundai Industries, Teekay Corporation, Samsung Heavy Industries, Yinson Holdings, Bluewater Energy Services and SBM offshore.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PROPULSION

- Self-propelled

- Double-hull

- Towed; Hull Type – Single-hull

MARKET, BY APPLICATION

- Deep Water

- Shallow Water

- Ultra-deep Water

MARKET, BY TYPE

- New-build

- Converted

- Redeployed

MARKET, BY OPERATOR

- Leased Operator

- Small Independent

- Large Independent

- National Oil Companies

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Propulsion

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Type

2.1.4. Market Snippet by Operator

2.1.5. Market Snippet by Region

2.2. Competitive Insights

3. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL MARKET – BY PROPULSION

6.1. Overview

6.1.1. Segment Share Analysis, By Propulsion, 2018 & 2025 (%)

6.2. Self-propelled

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Double-hull

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Towed; Hull Type – Single-hull

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2018 & 2025 (%)

7.2. Deep Water

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Shallow Water

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Ultra-deep Water

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL MARKET – BY TYPE

8.1. Overview

8.1.1. Segment Share Analysis, By Type, 2018 & 2025 (%)

8.2. New-build

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Converted

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Redeployed

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL MARKET – BY OPERATOR

9.1. Overview

9.1.1. Segment Share Analysis, By Operator, 2018 & 2025 (%)

9.2. Leased Operator

9.2.1. Overview

9.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.3. Small Independent

9.3.1. Overview

9.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.4. Large Independent

9.4.1. Overview

9.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9.5. National Oil Companies

9.5.1. Overview

9.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10. FLOATING PRODUCTION STORAGE AND OFF-LOADING (FPSO) VESSEL MARKET– BY GEOGRAPHY

10.1. Introduction

10.1.1. Segment Share Analysis, By Region, 2018 & 2025 (%)

10.2. North America

10.2.1. Overview

10.2.2. Key Manufacturers in North America

10.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.2.4. North America Market Size and Forecast, By Propulsion, 2014 – 2025 (US$ Million)

10.2.5. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

10.2.6. North America Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

10.2.7. North America Market Size and Forecast, By Operator, 2014 – 2025 (US$ Million)

10.2.8. U.S.

10.2.8.1. Overview

10.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.2.9. Canada

10.2.9.1. Overview

10.2.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3. Europe

10.3.1. Overview

10.3.2. Key Manufacturers in Europe

10.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.3.4. Europe Market Size and Forecast, By Propulsion, 2014 – 2025 (US$ Million)

10.3.5. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

10.3.6. Europe Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

10.3.7. Europe Market Size and Forecast, By Operator, 2014 – 2025 (US$ Million)

10.3.8. Germany

10.3.8.1. Overview

10.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.9. Italy

10.3.9.1. Overview

10.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.10. United Kingdom

10.3.10.1. Overview

10.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.11. France

10.3.11.1. Overview

10.3.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.3.12. Rest of Europe

10.3.12.1. Overview

10.3.12.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4. Asia Pacific (APAC)

10.4.1. Overview

10.4.2. Key Manufacturers in Asia Pacific

10.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.4.4. Asia Pacific Market Size and Forecast, By Propulsion, 2014 – 2025 (US$ Million)

10.4.5. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

10.4.6. Asia Pacific Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

10.4.7. Asia Pacific Market Size and Forecast, By Operator, 2014 – 2025 (US$ Million)

10.4.8. India

10.4.8.1. Overview

10.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.9. China

10.4.9.1. Overview

10.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.10. Japan

10.4.10.1. Overview

10.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.11. South Korea

10.4.11.1. Overview

10.4.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.4.12. Rest of APAC

10.4.12.1. Overview

10.4.12.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5. Latin America

10.5.1. Overview

10.5.2. Key Manufacturers in Latin America

10.5.3. Latin America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.5.4. Latin America Market Size and Forecast, By Propulsion, 2014 – 2025 (US$ Million)

10.5.5. Latin America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

10.5.6. Latin America Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

10.5.7. Latin America Market Size and Forecast, By Operator, 2014 – 2025 (US$ Million)

10.5.8. Brazil

10.5.8.1. Overview

10.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5.9. Mexico

10.5.9.1. Overview

10.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5.10. Argentina

10.5.10.1. Overview

10.5.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.5.11. Rest of LATAM

10.5.11.1. Overview

10.5.11.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.6. Middle East and Africa

10.6.1. Overview

10.6.2. Key Manufacturers in Middle East and Africa

10.6.3. Middle East and Africa Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

10.6.4. Middle East and Africa Market Size and Forecast, By Propulsion, 2014 – 2025 (US$ Million)

10.6.5. Middle East and Africa Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

10.6.6. Middle East and Africa Market Size and Forecast, By Type, 2014 – 2025 (US$ Million)

10.6.7. Middle East and Africa Market Size and Forecast, By Operator, 2014 – 2025 (US$ Million)

10.6.8. Saudi Arabia

10.6.8.1. Overview

10.6.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

10.6.9. United Arab Emirates

10.6.9.1. Overview

10.6.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

11. KEY VENDOR ANALYSIS

11.1. Aker Solution

11.1.1. Company Snapshot

11.1.2. Financial Performance

11.1.3. Propulsion Benchmarking

11.1.4. Strategic Initiatives

11.2. Modec

11.3. BW offshore

11.4. Bumi Armada Berhad

11.5. Hyundai Industries

11.6. Teekay Corporation

11.7. Samsung Heavy Industries

11.8. Yinson Holdings

11.9. Bluewater Energy Services

11.10. SBM offshore

12. 360 DEGREE ANALYSTVIEW

13. APPENDIX

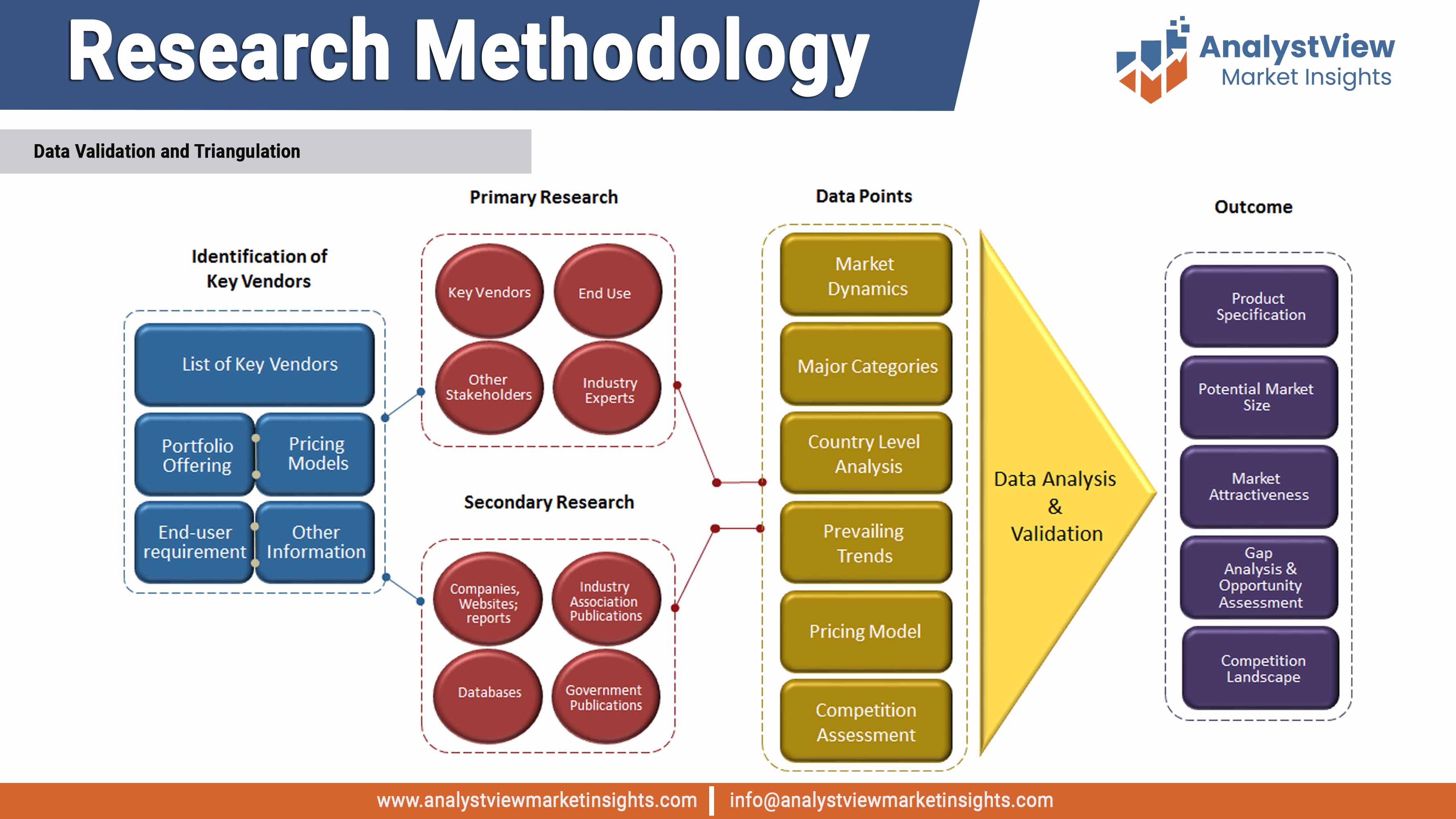

13.1. Research Methodology

13.2. References

13.3. Abbreviations

13.4. Disclaimer

13.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Floating Production Storage and Off-loading (FPSO) Vessel market: Propulsion snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Propulsion

TABLE Global Floating Production Storage and Off-loading (FPSO) Vessel market, by Propulsion 2014-2025 (USD Million)

TABLE Floating Production Storage and Off-loading (FPSO) Vessel market: Application Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Floating Production Storage and Off-loading (FPSO) Vessel market, by Application 2014-2025 (USD Million)

TABLE Floating Production Storage and Off-loading (FPSO) Vessel market: Type snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Type

TABLE Global Floating Production Storage and Off-loading (FPSO) Vessel market, by Type 2014-2025 (USD Million)

TABLE Floating Production Storage and Off-loading (FPSO) Vessel market: Operator snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Operator

TABLE Global Floating Production Storage and Off-loading (FPSO) Vessel market, by Operator 2014-2025 (USD Million)

TABLE Floating Production Storage and Off-loading (FPSO) Vessel market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Floating Production Storage and Off-loading (FPSO) Vessel market, by Region 2014-2025 (USD Million)

TABLE North America Floating Production Storage and Off-loading (FPSO) Vessel market, by Country, 2014-2025 (USD Million)

TABLE North America Floating Production Storage and Off-loading (FPSO) Vessel market, by Propulsion, 2014-2025 (USD Million)

TABLE North America Floating Production Storage and Off-loading (FPSO) Vessel market, by Application, 2014-2025 (USD Million)

TABLE Europe Floating Production Storage and Off-loading (FPSO) Vessel market, by country, 2014-2025 (USD Million)

TABLE Europe Floating Production Storage and Off-loading (FPSO) Vessel market, by Propulsion, 2014-2025 (USD Million)

TABLE Europe Floating Production Storage and Off-loading (FPSO) Vessel market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Floating Production Storage and Off-loading (FPSO) Vessel market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Floating Production Storage and Off-loading (FPSO) Vessel market, by Propulsion, 2014-2025 (USD Million)

TABLE Asia Pacific Floating Production Storage and Off-loading (FPSO) Vessel market, by Application, 2014-2025 (USD Million)

TABLE Latin America Floating Production Storage and Off-loading (FPSO) Vessel market, by country, 2014-2025 (USD Million)

TABLE Latin America Floating Production Storage and Off-loading (FPSO) Vessel market, by Propulsion, 2014-2025 (USD Million)

TABLE Latin America Floating Production Storage and Off-loading (FPSO) Vessel market, by Application, 2014-2025 (USD Million)

TABLE Middle East and Africa Floating Production Storage and Off-loading (FPSO) Vessel market, by country, 2014-2025 (USD Million)

TABLE Middle East and Africa Floating Production Storage and Off-loading (FPSO) Vessel market, by Propulsion, 2014-2025 (USD Million)

TABLE Middle East and Africa Floating Production Storage and Off-loading (FPSO) Vessel market, by Application, 2014-2025 (USD Million)

List of Figures

FIGURE Floating Production Storage and Off-loading (FPSO) Vessel market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Propulsion segment market share analysis, 2018 & 2025

FIGURE Propulsion segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Self-propelled market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Double-hull market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Towed; Hull Type – Single-hull Pumpers market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2018 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Deep Water market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Shallow Water market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Ulta-deep Water market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2018 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE New-build market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Converted market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Redeployed market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Operator segment market share analysis, 2018 & 2025

FIGURE Operator segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Leased Operator market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Small Independent market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Large Independent market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE National Oil Companies market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2018 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Floating Production Storage and Off-loading (FPSO) Vessel market share and leading players, 2018

FIGURE Europe Floating Production Storage and Off-loading (FPSO) Vessel market share and leading players, 2018

FIGURE Asia Pacific Floating Production Storage and Off-loading (FPSO) Vessel market share and leading players, 2018

FIGURE Latin America Floating Production Storage and Off-loading (FPSO) Vessel market share and leading players, 2018

FIGURE Middle East and Africa Floating Production Storage and Off-loading (FPSO) Vessel market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Spain market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Italy market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE UK market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE France market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Japan market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE South Korea market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Singapore market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of APAC market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America market share analysis by country, 2018

FIGURE Brazil market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Mexico market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Argentina market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of LATAM market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market share analysis by country, 2018

FIGURE Saudi Arabia market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE United Arab Emirates market size, forecast and trend analysis, 2014 to 2025 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS