Hydrocarbon Solvent Market, By Product (Aliphatic and Aromatic), By Application (Paints & Coatings, Rubbers and Polymers, Adhesives, Pharmaceuticals, and Agriculture Chemicals) and Geography (North America, Europe, Asia Pacific, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

|

Report ID

AV315

|

Published Date

July 2021

|

Pages

138

|

Industry

Bulk Chemicals

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

The Hydrocarbon Solvent market was valued at USD 8.93 billion by 2018, growing with 4.1% CAGR during the forecast period, 2018-2025.

Market Dynamics

Hydrocarbon solvents are molecules which contains only hydrogen and carbon atoms. These solvents are mainly present in the form of fractions during crude oil refinery. In contemporary times, the application of this organic chemical has increased across various industries. Rapid industrialization in emerging economies has paved the way for market growth too. It is evident in different verticals.

Hydrocarbon solvent is a coveted material of paint manufacturers. It is an important ingredient for manufacturing innovative products. Hence, it will leverage the global market growth. The boom of real-estate and infrastructure on a global scale will cause demand hike. The pharmaceutical industry is a big consumer of hydrocarbon solvent. Likewise, it finds wide usage of agricultural chemicals, and printing inks.

This product, on the downside has detrimental effects on human health. It may cause health hazards like eye irritation, dizziness, and respiratory problems. Hence, health concerns may act as a deterrent to global industry growth. Moreover, stringent government regulation on product approval acts as an impediment.

Product Takeaway

Product wise, the industry is classified into aromatic and aliphatic types. The market of aliphatic type will experience a boom facilitated through demand growth in the application industry like coating and paintings, particularly in emerging economies. However, the market is faced with an undeniable challenge as manufacturers are opting for a more environmentally friendly alternative like green solvents. Thus, one of the main inhibitors of aliphatic hydrocarbon solvents happens to be the stringent environmental regulations.

Whereas, xylene, toluene, and ethylbenzene solvents are the three main aromatic product types. The Xylene solvent segment will exhibit the highest growth in the forecast period due to increasing capacity and high solvency power.

Application Takeaway

On the basis of application, the market is broadly categorized as painting & coating, rubbers & polymer, adhesives, pharmaceuticals, agriculture chemicals and others. The coatings & painting segment will have the largest market share during the study period. Thanks to the surging growth in the appliances, machinery, and automotive OEM industry. Further, the massive undertaking of building and construction activities will push the demand.

Hydrocarbon solvents are one of the most potent cleanings and degreasing agents that are used for removing heavy mineral oil grease contamination. Solvent-based degreases are preferred because they can be easily segregated through oil-water separation. Hydrocarbon solvents are widely used in tire rubber compounding, and compounding of other products like shoe heel, shoe sole, rubber belts, flooring, light color rubber, and rubber tube. They are also used to dissolve the binders of printing inks, and for adjusting the viscosity of ink in printers.

Regional Takeaway

The market in the Asia Pacific will witness the highest growth owing to the increasing demand from coating and paintings application segment. Well, as the regulations governing the use of hydrocarbon solvents are lenient in the region it will pave the way for its increased usage, which is otherwise restricted through stringent rules and regulations in Europe and North America.

Key Vendor Takeaway

The major players in the global hydrocarbon solvent market are ExxonMobil Corporation, Total S.A., DowDuPont, Royal Dutch Shell, Ashland Inc., Sinopec, BP p.l.c., Eastman Chemical Company, Reliance Industries Limited, Chevron Corporation, Sasol Solvents, Ashland, and Engen Petroleum Limited. Key players are focusing on the formation of strategic alliance and partnerships with local players. For instance, BG Group formed single partner alliance with KBR, Inc., a hydrocarbons service provider. The engagement is aimed to provide project management expertise, technical support, and front end loading engineering services.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Aliphatic

- Aromatic

MARKET, BY APPLICATION

- Paints & Coatings

- Rubbers and Polymers

- Adhesives

- Pharmaceuticals

- Agriculture Chemicals

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- The Middle East and Africa

- Latin America

TABLE OF CONTENT

1. HYDROCARBON SOLVENT MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. HYDROCARBON SOLVENT KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. HYDROCARBON SOLVENT INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. HYDROCARBON SOLVENT MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. HYDROCARBON SOLVENT MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2017 & 2025 (%)

6.2. Aliphatic

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Aromatic

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. HYDROCARBON SOLVENT MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2017 & 2025 (%)

7.2. Paints & Coatings

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Rubbers and Polymers

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Adhesives

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Pharmaceuticals

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6. Agriculture Chemicals

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.7. Others

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. HYDROCARBON SOLVENT MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2017 & 2025 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.3.6. France

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.7. Germany

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.8. Rest of Europe

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.4.6. China

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.7. India

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.8. Rest of APAC

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Key Manufacturers in Rest of the World

8.5.3. Rest of the World Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.5.4. Rest of the World Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.5.5. Rest of the World Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.5.6. Latin America

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.7. Middle East and Africa

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. ExxonMobil Corporation

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Total S.A.

9.2.1. Company Snapshot

9.2.2. Financial Performance

9.2.3. Product Benchmarking

9.2.4. Strategic Initiatives

9.3. DowDuPont

9.3.1. Company Snapshot

9.3.2. Financial Performance

9.3.3. Product Benchmarking

9.3.4. Strategic Initiatives

9.4. Royal Dutch Shell

9.4.1. Company Snapshot

9.4.2. Financial Performance

9.4.3. Product Benchmarking

9.4.4. Strategic Initiatives

9.5. Ashland Inc.

9.5.1. Company Snapshot

9.5.2. Financial Performance

9.5.3. Product Benchmarking

9.5.4. Strategic Initiatives

9.6. Sinopec, BP p.l.c.

9.6.1. Company Snapshot

9.6.2. Financial Performance

9.6.3. Product Benchmarking

9.6.4. Strategic Initiatives

9.7. Eastman Chemical Company

9.7.1. Company Snapshot

9.7.2. Financial Performance

9.7.3. Product Benchmarking

9.7.4. Strategic Initiatives

9.8. Reliance Industries Limited

9.8.1. Company Snapshot

9.8.2. Financial Performance

9.8.3. Product Benchmarking

9.8.4. Strategic Initiatives

9.9. Chevron Corporation

9.9.1. Company Snapshot

9.9.2. Financial Performance

9.9.3. Product Benchmarking

9.9.4. Strategic Initiatives

9.10. Sasol Solvents

9.10.1. Company Snapshot

9.10.2. Financial Performance

9.10.3. Product Benchmarking

9.10.4. Strategic Initiatives

9.11. Ashland

9.11.1. Company Snapshot

9.11.2. Financial Performance

9.11.3. Product Benchmarking

9.11.4. Strategic Initiatives

9.12. Engen Petroleum Limited

9.12.1. Company Snapshot

9.12.2. Financial Performance

9.12.3. Product Benchmarking

9.12.4. Strategic Initiatives

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

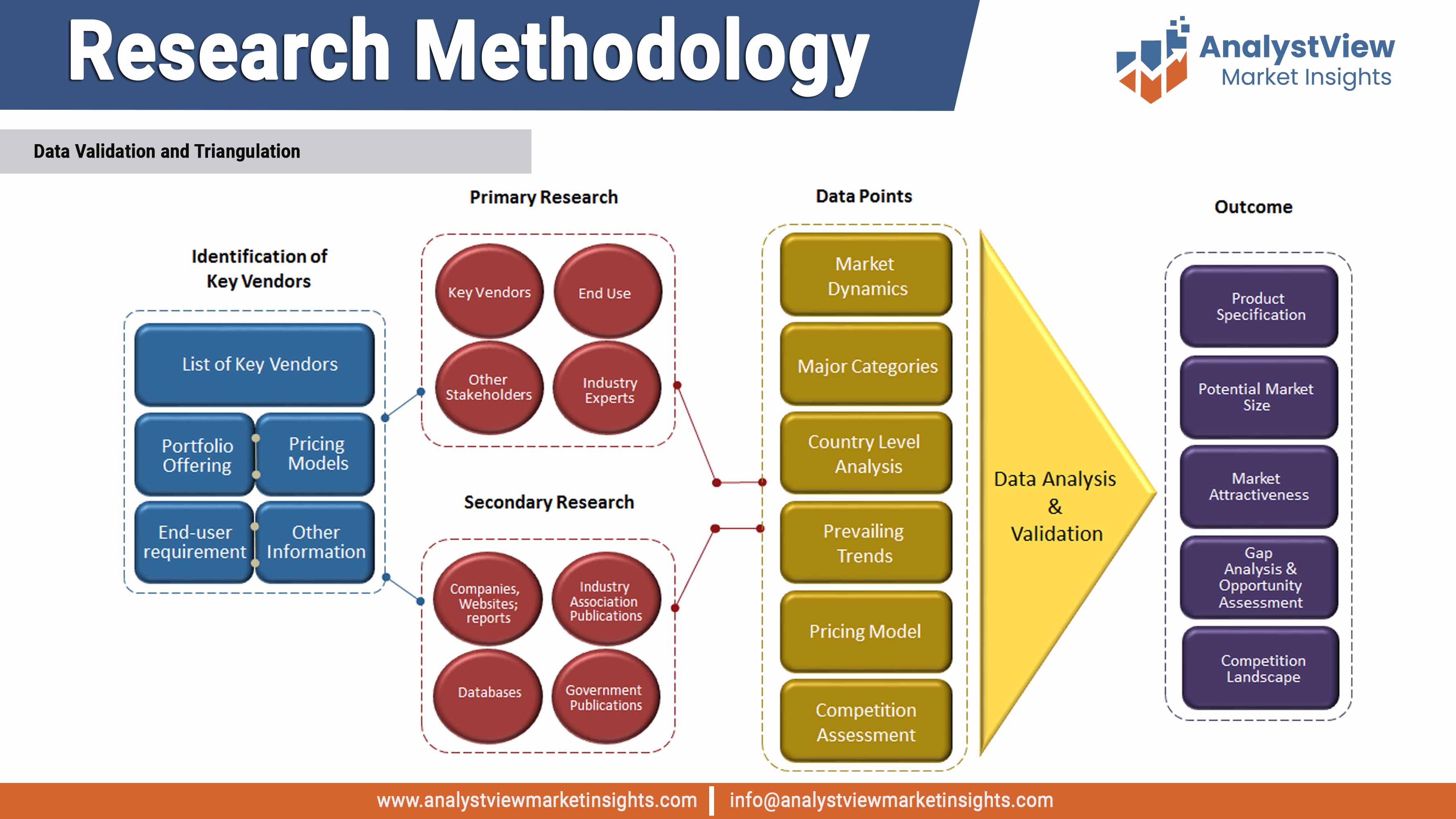

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data Technologys

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Hydrocarbon Solvent Market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Hydrocarbon Solvent Market, by Product 2014-2025 (USD Million)

TABLE Hydrocarbon Solvent Market: Application snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Hydrocarbon Solvent Market: regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by region

TABLE Global Hydrocarbon Solvent Market, by region 2014-2025 (USD Million)

TABLE North America Hydrocarbon Solvent Market, by country, 2014-2025 (USD Million)

TABLE North America Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE North America Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE U.S. Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE U.S. Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Canada Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Canada Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Europe Hydrocarbon Solvent Market, by country, 2014-2025 (USD Million)

TABLE Europe Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Europe Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Germany Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Germany Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE U.K. Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE U.K. Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Rest of the Europe Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Rest of the Europe Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Hydrocarbon Solvent Market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Asia Pacific Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Japan Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Japan Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE China Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE China Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Rest of Asia Pacific Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Rest of the World Hydrocarbon Solvent Market, by country, 2014-2025 (USD Million)

TABLE Rest of the World Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Rest of the World Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Latin America Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Latin America Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

TABLE Middle East and Africa Hydrocarbon Solvent Market, by Product, 2014-2025 (USD Million)

TABLE Middle East and Africa Hydrocarbon Solvent Market, by Application, 2014-2025 (USD Million)

List of Figures

FIGURE Hydrocarbon Solvent Market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2017 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Aliphatic market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Aromatic market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2017 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Paints & Coatings market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rubbers and Polymers market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Adhesives market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Pharmaceuticals market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Agriculture Chemicals market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2017 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Hydrocarbon Solvent Market share and leading players, 2018

FIGURE Europe Hydrocarbon Solvent Market share and leading players, 2018

FIGURE Asia Pacific Hydrocarbon Solvent Market share and leading players, 2018

FIGURE Latin America Hydrocarbon Solvent Market share and leading players, 2018

FIGURE Middle East and Africa Hydrocarbon Solvent Market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE U.K. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of Asia Pacific market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the World market share analysis by country, 2018

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS