Metallic Pigments Market, By Product (Zinc, Aluminum, Copper and Stainless steel), By Application (Paints & Coatings, Printing Inks, Plastics and Cosmetics), and by Geography (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) Analysis, Share, Trends, Size, & Forecast from 2019 2025

|

Report ID

AV428

|

Published Date

October 2020

|

Pages

160

|

Industry

Bulk Chemicals

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

The Metallic Pigments Market was valued at USD 980.6 million by 2018, growing with 5.2% CAGR during the forecast period, 2019-2025.

Market Dynamics

Metallic pigment (i.e. metallic finishes) are coatings material that contains flat, irregular and reflective pigments. Such pigments can be a micaceous iron oxide, aluminum flake or mica. The industry growth is driven by the increasing number of car sales owing to the recent developments in the automotive industry. The increased sales on account of effective aesthetic appeal have been the trend globally, and it is expected to spur the demand for metallic pigments. Growing product applications in packaging, cosmetics, and printing ink industries are anticipated to boost demand for metallic pigments further.

Product Type Takeaway

The metallic pigments market is segmented by product type depending upon the base element utilized into aluminum, zinc, copper, stainless steel, and heavy metals such as cadmium and chromium. The aluminum segment dominated the overall metallic pigments market of the worldwide share. This segment is expected to witness considerable growth of over 5.5% over the projected period. The increasing adoption of various high sheen powder coatings to enhance the metallic luster and special effects is expected to boost the demand for aluminum in different grades such as vacuum metalized, leafing, and non-leafing metallic pigments.

Copper and Zinc follow the aluminum segment based on the global market share, and it is expected that these segments will also witness high demand owing to the increased demand and preference for a special golden bronze color texture especially in cosmetics. The copper segment is anticipated to observe strong growth over the projected period. The use of heavy metals such as iron oxide, cadmium, and chromium in the paints & coatings industry is expected to witness a declining trend owing to the stringent government guidelines related to the toxicity of these metals.

Application Takeaway

Based on the application, the metallic pigments market is segmented into printing inks, paints & coatings, cosmetics and plastics. Paints & coating application is the largest segment accounting for over 40% of the worldwide industry share owing to the strict guidelines related to low volatile organic compound (VOC) content in paints. Marine Coating is considered to be one of the major applications, driving the demand on account of corrosion resistance provided by metallic pigments. Evolving fashion trends in developing nations such as the Asia Pacific and Latin America is expected to spur segment growth. Increasing research and development activities have initiated technological advancements that introduced sparkling appearance with high durability for processing and paint refinishes.

The printing inks segment is the second-largest application segment, and it is projected to witness steady growth owing to increased utilization of offset inks in gravure, flexography, and digital inks. The cosmetics industry is expected to grow at a high rate on account of rising attention given to beauty & appearance coupled with increasing demand for different color effects, brilliant texture, and finishes.

Regional Takeaway

The Asia Pacific is the dominant region accounting for over 34% of global volume in 2018, and it is expected to register the highest growth over the study period. Increased development & construction activities in India, China, and other southeast Asian countries, coupled with governmental guidelines for green products is likely to drive demand in the construction and paints industry. Increased application in end-use industries such as packaging, automotive, and plastics is also anticipated to drive the market growth in this region.

Latin America is also expected to witness considerable growth owing to increasing urbanization and evolving fashion trends coupled with rising awareness regarding the sustainability of pigments. Countries such as Argentina, South Africa, UAE, and Saudi Arabia are also anticipated to drive product demand over the forecast period.

Key Vendors Takeaway

Major market players are BASF, Asahi Kasei Corporation, Carl Schlenk AG, Sun Chemical Corporation, Sudarshan Chemicals, Umicore N.V., Ferro Corporation, Carlfors Bruk, Toyal America, Inc., Siberline Manufacturing Co., and Geotech International B.V.

Companies undertake various strategies such as product developments & innovations, collaborations, mergers, and joint ventures to gain a competitive edge in the market. Schlenk Metallic Pigment’s Powdal SDT pigment for the powder coating industry & AluMotion products for automotive OEMs, Sun Chemical’s Benda-Lutz Maxal EC product for the architectural powder coatings, and BASF’s Paliocrom sparkling red pigment for automotive and industrial styling are some of the recent product developments by key market vendors.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 to 2017

- Base Year – 2018

- Estimated Year – 2019

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Zinc

- Aluminum

- Copper

- Stainless steel

- Others

MARKET, BY APPLICATION

- Paints & Coatings

- Printing Inks

- Plastics

- Cosmetics

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. METALLIC PIGMENTS MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. METALLIC PIGMENTS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. METALLIC PIGMENTS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. METALLIC PIGMENTS MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. METALLIC PIGMENTS MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2018 & 2025 (%)

6.2. Zinc

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Aluminum

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Copper

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5. Stainless steel

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.6. Others

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. METALLIC PIGMENTS MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2018 & 2025 (%)

7.2. Paints & Coatings

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Printing Inks

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Plastics

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Cosmetics

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6. Others

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. METALLIC PIGMENTS MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2018 & 2025 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.3.6. Germany

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.7. Italy

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.8. United Kingdom

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.9. France

8.3.9.1. Overview

8.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.10. Rest of Europe

8.3.10.1. Overview

8.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

India

8.4.5.1. Overview

8.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.6. China

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.7. Japan

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.8. South Korea

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.9. Rest of APAC

8.4.9.1. Overview

8.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Latin America

8.5.1. Overview

8.5.2. Key Manufacturers in Latin America

8.5.3. Latin America Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.5.4. Latin America Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.5.5. Latin America Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.5.6. Brazil

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.7. Mexico

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.8. Argentina

8.5.8.1. Overview

8.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.9. Rest of LATAM

8.5.9.1. Overview

8.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.6. Middle East and Africa

8.6.1. Overview

8.6.2. Key Manufacturers in Middle East and Africa

8.6.3. Middle East and Africa Market Size and Forecast, By Country, 2014 – 2025 (US$ Million)

8.6.4. Middle East and Africa Market Size and Forecast, By Product, 2014 – 2025 (US$ Million)

8.6.5. Middle East and Africa Market Size and Forecast, By Application, 2014 – 2025 (US$ Million)

8.6.6. Saudi Arabia

8.6.6.1. Overview

8.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.6.7. United Arab Emirates

8.6.7.1. Overview

8.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. BASF SE

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Asahi Kasei Corporation

9.3. Carl Schlenk AG

9.4. Sun Chemical Corporation

9.5. Sudarshan Chemicals

9.6. Umicore N.V.

9.7. Ferro Corporation

9.8. Carlfors Bruk

9.9. Toyal America, Inc.

9.10. Siberline Manufacturing Company

9.11. Geotech International B.V

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

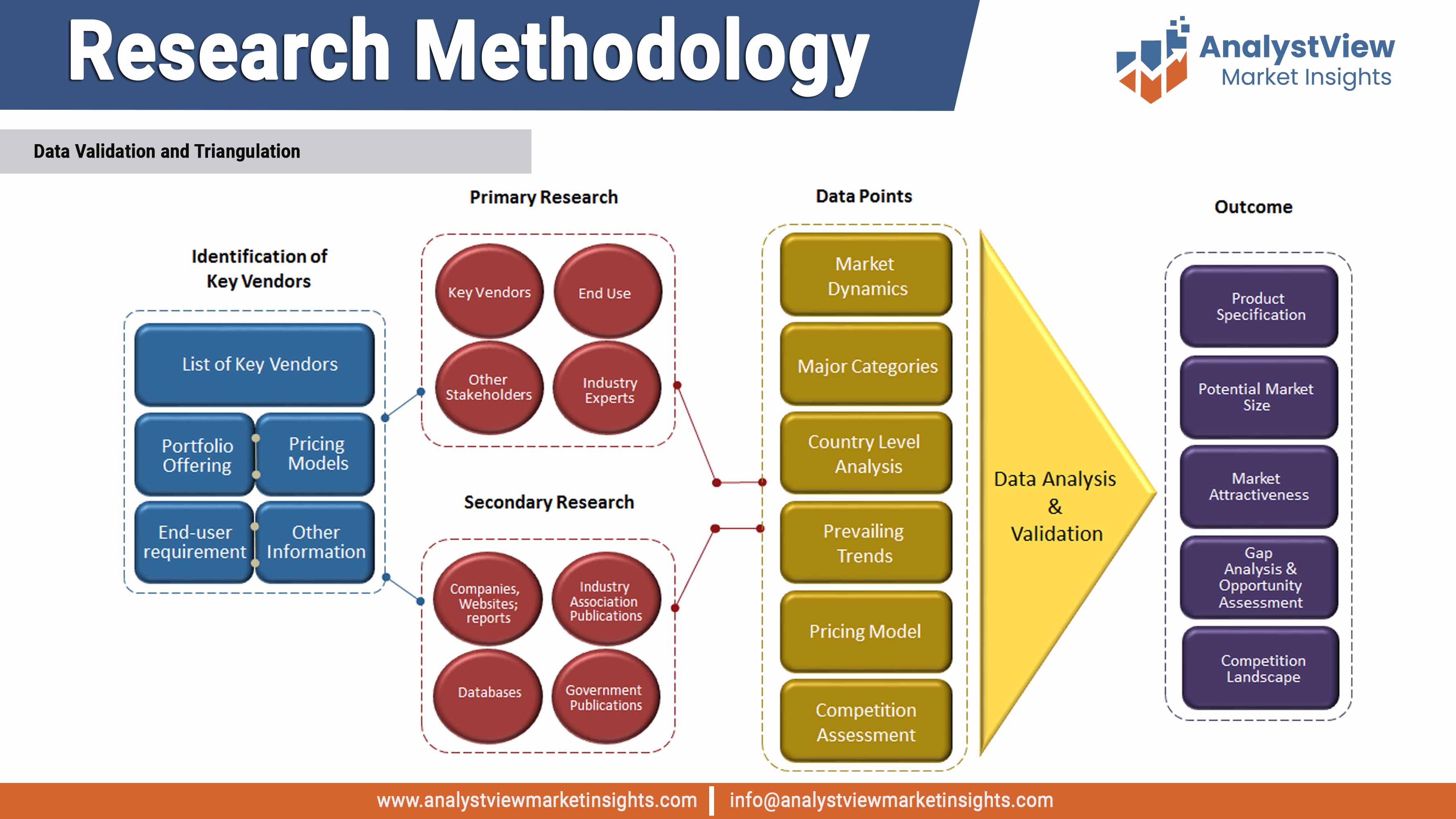

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Metallic Pigments market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Metallic Pigments market, by Product 2014-2025 (USD Million)

TABLE Metallic Pigments market: Application Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Metallic Pigments market, by Application 2014-2025 (USD Million)

fTABLE Metallic Pigments market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Metallic Pigments market, by Region 2014-2025 (USD Million)

TABLE North America Metallic Pigments market, by Country, 2014-2025 (USD Million)

TABLE North America Metallic Pigments market, by Product, 2014-2025 (USD Million)

TABLE North America Metallic Pigments market, by Application, 2014-2025 (USD Million)

TABLE Europe Metallic Pigments market, by country, 2014-2025 (USD Million)

TABLE Europe Metallic Pigments market, by Product, 2014-2025 (USD Million)

TABLE Europe Metallic Pigments market, by Application, 2014-2025 (USD Million)

TABLE Asia Pacific Metallic Pigments market, by country, 2014-2025 (USD Million)

TABLE Asia Pacific Metallic Pigments market, by Product, 2014-2025 (USD Million)

TABLE Asia Pacific Metallic Pigments market, by Application, 2014-2025 (USD Million)

TABLE Rest of the World Metallic Pigments market, by country, 2014-2025 (USD Million)

TABLE Rest of the World Metallic Pigments market, by Product, 2014-2025 (USD Million)

TABLE Rest of the World Metallic Pigments market, by Application, 2014-2025 (USD Million)

List of Figures

FIGURE Metallic Pigments market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2018 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Zinc market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Aluminum market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Copper market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Stainless steel market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2018 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Paints & Coatings market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Printing Inks market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Plastics market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Cosmetics market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Others market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Regional segment market share analysis, 2018 & 2025

FIGURE Regional segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE North America Metallic Pigments market share and leading players, 2018

FIGURE Europe Metallic Pigments market share and leading players, 2018

FIGURE Asia Pacific Metallic Pigments market share and leading players, 2018

FIGURE Latin America Metallic Pigments market share and leading players, 2018

FIGURE Middle East and Africa Metallic Pigments market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Canada market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Europe market share analysis by country, 2018

FIGURE Germany market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Italy market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE UK market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE France market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of the Europe market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Asia Pacific market share analysis by country, 2018

FIGURE India market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE China market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Japan market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE South Korea market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of APAC market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Latin America market share analysis by country, 2018

FIGURE Brazil market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Mexico market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Argentina market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Rest of LATAM market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Middle East and Africa market share analysis by country, 2018

FIGURE Saudi Arabia market size, forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE United Arab Emirates market size, forecast and trend analysis, 2014 to 2025 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS