Point of Care (POC) Diagnostics Market, By Product (Glucose Testing, Hb1Ac Testing, Coagulation, Urinalysis, Fertility, Cardiac Markers, Infectious Diseases, and others), By Disease Condition, And Geography (North America, Europe, Asia Pacific, And RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The point of care (POC) diagnostics market is estimated to represent a global market of USD 16,237 million by 2017 with growth rate of 7.1%.

Point of care testing is a medical tool, designed to perform outside the physical facilities such as clinical laboratories. These tests are primarily used to diagnose various chronic disease conditions such as diabetes, cardiovascular disorders, infectious diseases and others.

Market Dynamics

Point of care diagnostics market is primarily driven by the rising demand for home healthcare coupled with continuous aging population across the world. World Health Organization (WHO) has projected that aging population, over 60 years, will be doubled, from 12% (2015) to 22% (2050). Similarly, According to the Population Reference Bureau (PRB), geriatric population (over 65 years) is projected to double in America by the next few years. Considering these facts, several initiatives undertaken by governments to shorten hospital stays by establishing out-patient care models which will surge in demand for POC diagnostics, augmenting the market growth.

Additionally, favorable regulatory initiatives, aimed at promoting a point of care diagnosis is anticipated to serve the industry as a high impact rendering driver. For example, the U.S. government (U.S. FDA) introduced CLIA (clinical laboratory improvement amendments) in partnership with the Centres for Medicare & Medicaid Services (CMS) and the Centre for Disease Control (CDC). This regulation aims to conduct laboratory inspection and enforce regulatory compliances in order to assure quality laboratory testing, expected to boost usage rates of POC during the forecast period. Furthermore, increasing funding, from organizations such as National Institute of Biomedical Imaging and Bioengineering, the U.S. Department of Defence (DOD), and the Bill and Melinda Gates Foundation, for the development of point of care diagnostics support the industry growth to great extent. Introduction of mobile applications such as cobas infinity point-of-care (Roche Diagnostics), growing demand for point of care diagnostics, and rising investment by companies is expected to spur the growth in the coming years. However, the regulatory framework for approval process has been the most critical restraining factor for the industry growth.

Products Takeaway

In terms of products, the market is categorized as Glucose Testing, Hb1Ac Testing, Coagulation, Urinalysis, Fertility, Cardiac Markers, Infectious Diseases, Hematology, Decentralized Clinical Chemistry, Ambulatory Chemistry, Drug Abuse Testing, and others. Among which, glucose testing and Hb1Ac testing accounted for the largest share of the global market. Collectively, these segments achieved around USD 9.5 billion in 2017 and are anticipated to dominate the industry. However, cardiac markers segment is projected to grow with the highest growth rate over the forecast period.

Disease Condition Takeaway

Based on disease conditions, the market is broadly categorized into Human Immunodeficiency Virus (HIV), Respiratory Syncytial, Human papillomavirus (HPV), Clostridium difficile, Hepatitis B, Pneumonia, Influenza, Hepatitis C, Tuberculosis, and others. Use of molecular diagnostics for the treatment of HIV is rapidly increasing, accounting for the largest market. According to Canada’s Source for HIV and Hepatitis C information, the point of care diagnosis is a rapid testing technique for HIV patients that provides testing results in short time span, usually in an hour. In terms of end users, the market is distributed as Hospitals, Home, Laboratory Settings, and Others.

Regional Takeaway

Regionally the market is classified in North America, Europe, Asia Pacific and Rest of the world. Increasing population base with cardio metabolic disorders and diabetes is expected to stimulate the market growth in North America and Europe. According to the Centers for Disease Control and Prevention (CDC), over 31% of population in the U.S. was suffering from bad cholesterol or LDL in 2012. On other side, large patient base coupled with the growing demand for in-vitro diagnostics in developing regions such as India and China provides a healthy platform for the POC growth in developing regions.

Asia Pacific Point of Care Diagnostics Market by Country, 2017 vs 2025

Key Vendor Takeaway

Companies such as Danaher Corporation, Roche Diagnostics, Alere Inc., bioMerieux, Abbott Laboratories, and Siemens Healthcare are profiled in the report. Strategic merger and acquisitions and the introduction of new products helped companies to capture significant revenue share. For example, Alere, Inc., one of the leader in rapid point of care diagnosis testing, hold strong distribution channel across the world in order to supply its products to laboratories, physicians’ clinics, and hospitals. This company also operates via third-party distributors for selling its products. Key distributor partners of the company include Henry Schein Medical, McKesson, NDC, Cardinal Health, Medline, Merck, Menearini Diagnostics, and Orion Diagnostica Oy.

The market size and forecast for each segment has been provided for the period 2014 to 2025, considering 2015 as the base year. The report also provides the compounded annual growth rate (% CAGR) for the forecast period 2016 to 2025 for every reported segment.

The years considered for the study are:

- Historical Year – 2014 & 2015

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, And Suppliers

- Manufacturers

- Hospitals

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCT

- Glucose Testing

- Hb1Ac Testing

- Coagulation

- Urinalysis

- Fertility

- Cardiac Markers

- Infectious Diseases

- Hematology

- Decentralized Clinical Chemistry

- Ambulatory Chemistry

- Drug Abuse Testing

- Others

MARKET, BY DISEASE CONDITION

- Human Immunodeficiency Virus (HIV)

- Respiratory Syncytial

- Human papillomavirus (HPV)

- Clostridium difficile

- Hepatitis B

- Pneumonia

- Influenza

- Hepatitis C

- Tuberculosis

- Others

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. POC LIPID DIAGNOSTICS MARKET OVERVIEW

1.1. Study Scope

1.2. Base Year

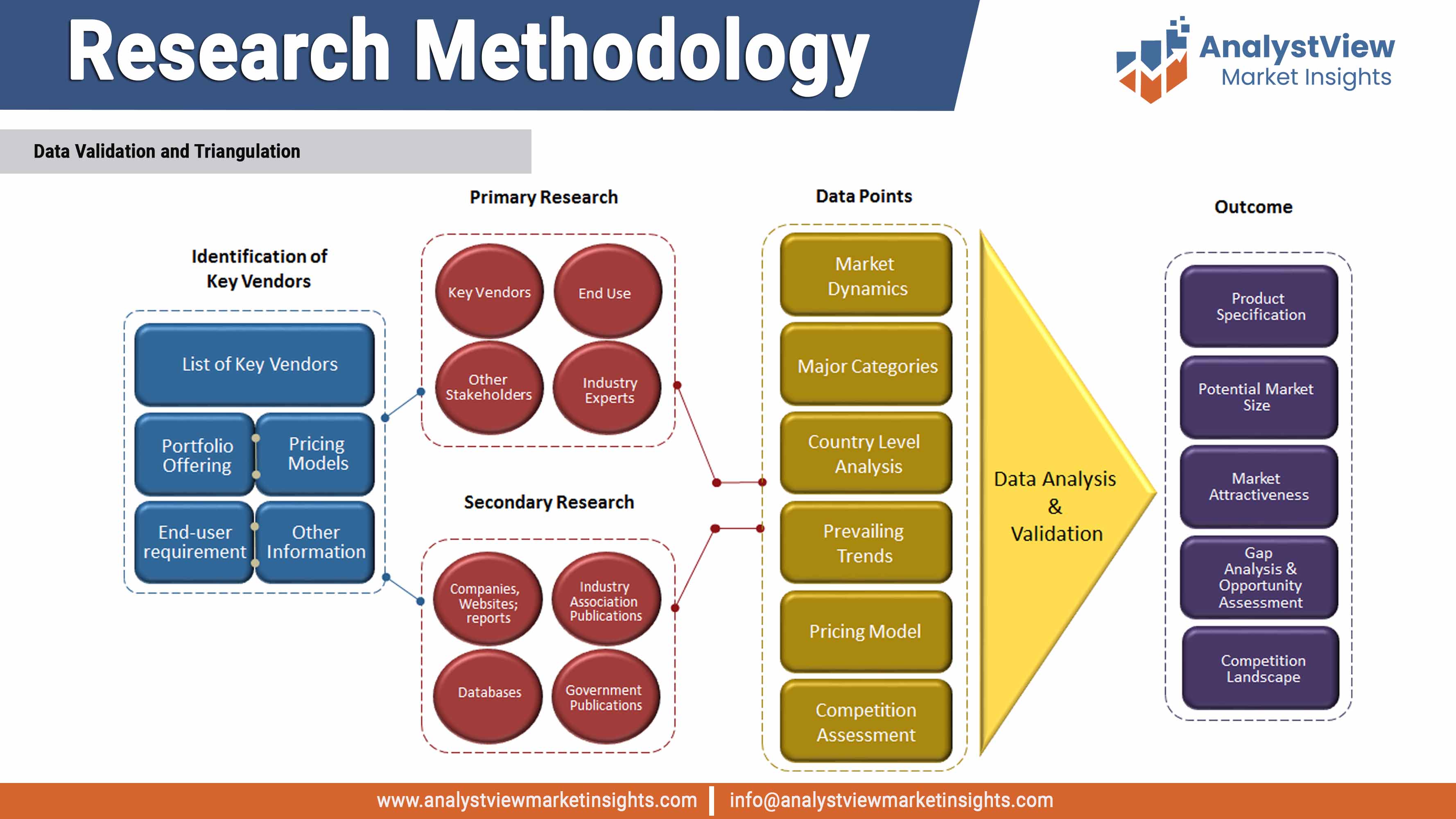

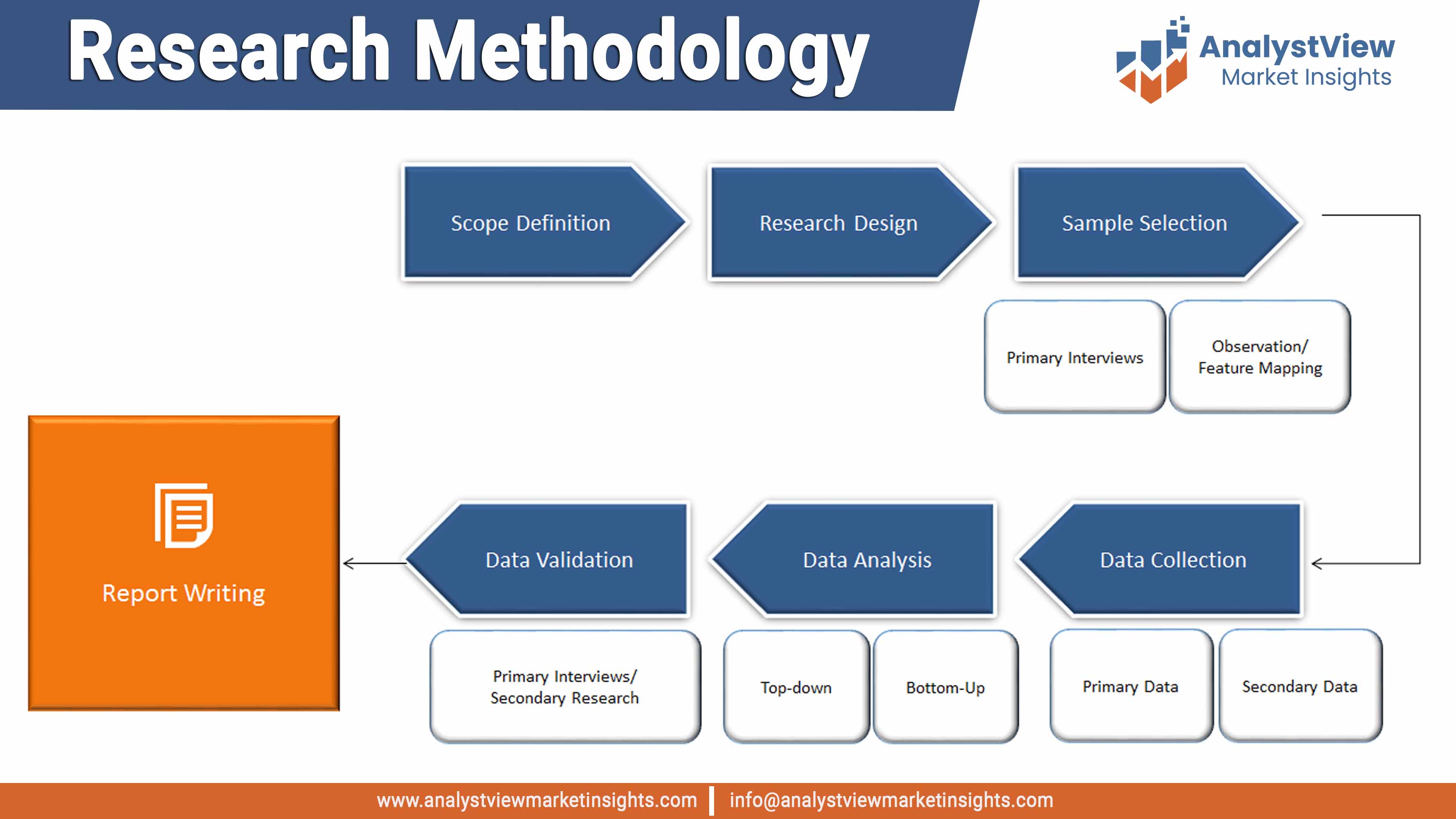

1.3. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. POC LIPID DIAGNOSTICS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trend

4. POC LIPID DIAGNOSTICS INDUSTRY STUDY

4.1. Porter’s Analysis

4.2. Regulatory Framework Analysis

4.3. Market Attractiveness Analysis

4.4. Value Chain Analysis

5. POC LIPID DIAGNOSTICS MARKET LANDSCAPE

5.1. Market Share Analysis

6. POC LIPID DIAGNOSTICS MARKET – BY APPLICATION:

6.1. Overview

6.2. Hyperlipidemia

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Hypertriglyceridemia

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Familial hypercholesterolemia

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5. Hyperlipoproteinemia

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.6. Tangier disease

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.7. Others

6.7.1. Overview

6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. POC LIPID DIAGNOSTICS MARKET – BY INSTRUMENT:

7.1. Overview

7.2. Roche Cobas b 101

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Abaxis Piccolo Xpress

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Roche Reflotron

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Alere Cholestech LDX

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.6. Alere Afinion

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.7. Samsung LABGEO PT10

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.8. Cardiocheck

7.8.1. Overview

7.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. POC LIPID DIAGNOSTICS MARKET– BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.3. U.S.

8.2.3.1. Overview

8.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.2.4. Canada

8.2.4.1. Overview

8.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.3. France

8.3.3.1. Overview

8.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.4. Germany

8.3.4.1. Overview

8.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.3.5. Rest of Europe

8.3.5.1. Overview

8.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.3. China

8.4.3.1. Overview

8.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.4. India

8.4.4.1. Overview

8.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.4.5. Rest of APAC

8.4.5.1. Overview

8.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.3. Latin America

8.5.3.1. Overview

8.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8.5.4. Middle East and Africa

8.5.4.1. Overview

8.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Samsung

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

9.2. Roche Diagnostics

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

9.3. Alere

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

9.4. Abaxis, Inc.

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

9.5. Bio-Rad Laboratories

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

*Client can request additional company profiling as per specific requirements

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

11.1. Research Methodology

11.2. Abbreviations

11.3. Disclaimer

11.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PEST Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global POC Lipid Diagnostics Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

Table 10 POC Lipid Diagnostics Market, by Application, 2014 – 2025 (USD Million)

Table 11 POC Lipid Diagnostics Market, by Instruments, 2014 – 2025 (USD Million)

Table 12 POC Lipid Diagnostics Market, by Geography, 2014 – 2025 (USD Million)

Table 13 North America POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 14 U.S. POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 15 Canada POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 16 Europe POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 17 France POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 18 Germany POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 19 Asia Pacific POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 20 China POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 21 India POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 22 Latin America POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

Table 23 MEA POC Lipid Diagnostics Market, 2014 – 2025 (USD Million)

List of Figures

Figure 1 Research Methdology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 Value Chain Analysis Analysis

Figure 6 POC Lipid Diagnostics Market, by Application, 2014 – 2025 (USD Million)

Figure 7 POC Lipid Diagnostics Market, by Instrument, 2014 – 2025 (USD Million)

Figure 8 POC Lipid Diagnostics Market, by Geography, 2014 – 2025 (USD Million)