U.S. Dredging Services Market, By Products (Capital Dredging, Remediation Dredging, Maintenance Dredging, Reclamation Dredging, Beach Nourishment) and Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

Report Code: AV281

Industry: Semiconductor and Electronics

Publiced On: 2020-06-01

Pages: 108

Format:

REPORT HIGHLIGHT

The U.S. dredging services market was valued at USD 2,160 million by 2017, growing with 1.31% CAGR during the forecast period, 2018-2025

Dredging is the removal of debris and sediments from the bottom of rivers, harbors, and other water containing locations. Dredging is vital to economic and social development, in particular to the construction and maritime infrastructure upon which worldwide economic prosperity and environmental well-being depends. Growing demand from harbour and port operations coupled with favourable government funding for transportation support the industry growth. Harbor and port accounted for the largest downstream marketplace as dredging services are essential to maintaining efficient and safe navigation channels. There is currently increasing demand for dredging services in most of the country’s ports. As per the U.S. federal agency, “US Army Corps of Engineers”, approximately one-third of commercial vessels at the U.S. ports are constrained due to inadequate channel depths.

In addition, growing acceptance of dredging as a means of environmental preservation and restoration will further stimulate the market demand. However, funds allocated to dredging services in the country have been insufficient to meet demand which will slow down the industry growth to some extent. In addition, high start-up costs of dredging equipment and vessels are a significant barrier to entry for new players.

Products Takeaway

In terms of products, the market is categorized as;

- Capital dredging

- Remediation dredging

- Maintenance dredging

- Reclamation dredging

- Beach nourishment

Of the different products, capital dredging accounted for the highest revenue share. Capital dredging services are provided to create a new harbor, berth or waterway, or to expand existing waterways to allow larger ships to access them. This segment also covers trench digging for tunnels, cables, construction of breakwaters, canals and other marine locations.

Application Takeaway

In terms of application, the market is categorized as;

- Public infrastructure

- Public land

- Private Projects

Private projects account for a very small portion of industry revenue. Such projects include dredging ponds and lakes on private land and work along riverbanks. Public infrastructure and public land segment is expected to grow with promising growth rate over the forecast period.

Key Vendors Takeaway

- SOLitude Lake Management

- Great Lakes Dredge and Dock Company

- Gator Dredging

- Aqua Doc

- McCullough Excavating

- Eco Waterway Services

- Manson Construction Company

- AE Commercial Diving Services

The industry is highly fragmented, with the presence of large number of small scale companies. Smaller dredging operations tend to service inland areas and focus on rivers and lakes, as opposed to coastal waterways. Key players in the industry have invested in larger, more fuel-efficient dredges to improve operational efficiencies and reduce operational costs.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY PRODUCTS

- Capital Dredging

- Remediation Dredging

- Maintenance Dredging

- Reclamation Dredging

- Beach Nourishment

MARKET, BY APPLICATION

- Public Infrastructure

- Public Land

- Private Projects

TABLE OF CONTENT

1. U.S. DREDGING SERVICES MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.2. Competitive Insights

3. U.S. DREDGING SERVICES KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. U.S. DREDGING SERVICES INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. U.S. DREDGING SERVICES MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. U.S. DREDGING SERVICES MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2017 & 2025 (%)

6.2. Capital Dredging

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Remediation Dredging

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Maintenance Dredging

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5. Reclamation Dredging

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.6. Beach Nourishment

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. U.S. DREDGING SERVICES MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2017 & 2025 (%)

7.2. Public Infrastructure

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Public Land

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Private Projects

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. KEY VENDOR ANALYSIS

8.1. SOLitude Lake Management

8.1.1. Company Snapshot

8.1.2. Financial Performance

8.1.3. Product Benchmarking

8.1.4. Strategic Initiatives

8.2. Great Lakes Dredge and Dock Company

8.2.1. Company Snapshot

8.2.2. Financial Performance

8.2.3. Product Benchmarking

8.2.4. Strategic Initiatives

8.3. Gator Dredging

8.3.1. Company Snapshot

8.3.2. Financial Performance

8.3.3. Product Benchmarking

8.3.4. Strategic Initiatives

8.4. Aqua Doc

8.4.1. Company Snapshot

8.4.2. Financial Performance

8.4.3. Product Benchmarking

8.4.4. Strategic Initiatives

8.5. McCullough Excavating

8.5.1. Company Snapshot

8.5.2. Financial Performance

8.5.3. Product Benchmarking

8.5.4. Strategic Initiatives

8.6. Eco Waterway Services

8.6.1. Company Snapshot

8.6.2. Financial Performance

8.6.3. Product Benchmarking

8.6.4. Strategic Initiatives

8.7. Manson Construction Company

8.7.1. Company Snapshot

8.7.2. Financial Performance

8.7.3. Product Benchmarking

8.7.4. Strategic Initiatives

8.8. AE Commercial Diving Services

8.8.1. Company Snapshot

8.8.2. Financial Performance

8.8.3. Product Benchmarking

8.8.4. Strategic Initiatives

9. 360 DEGREE ANALYSTVIEW

10. APPENDIX

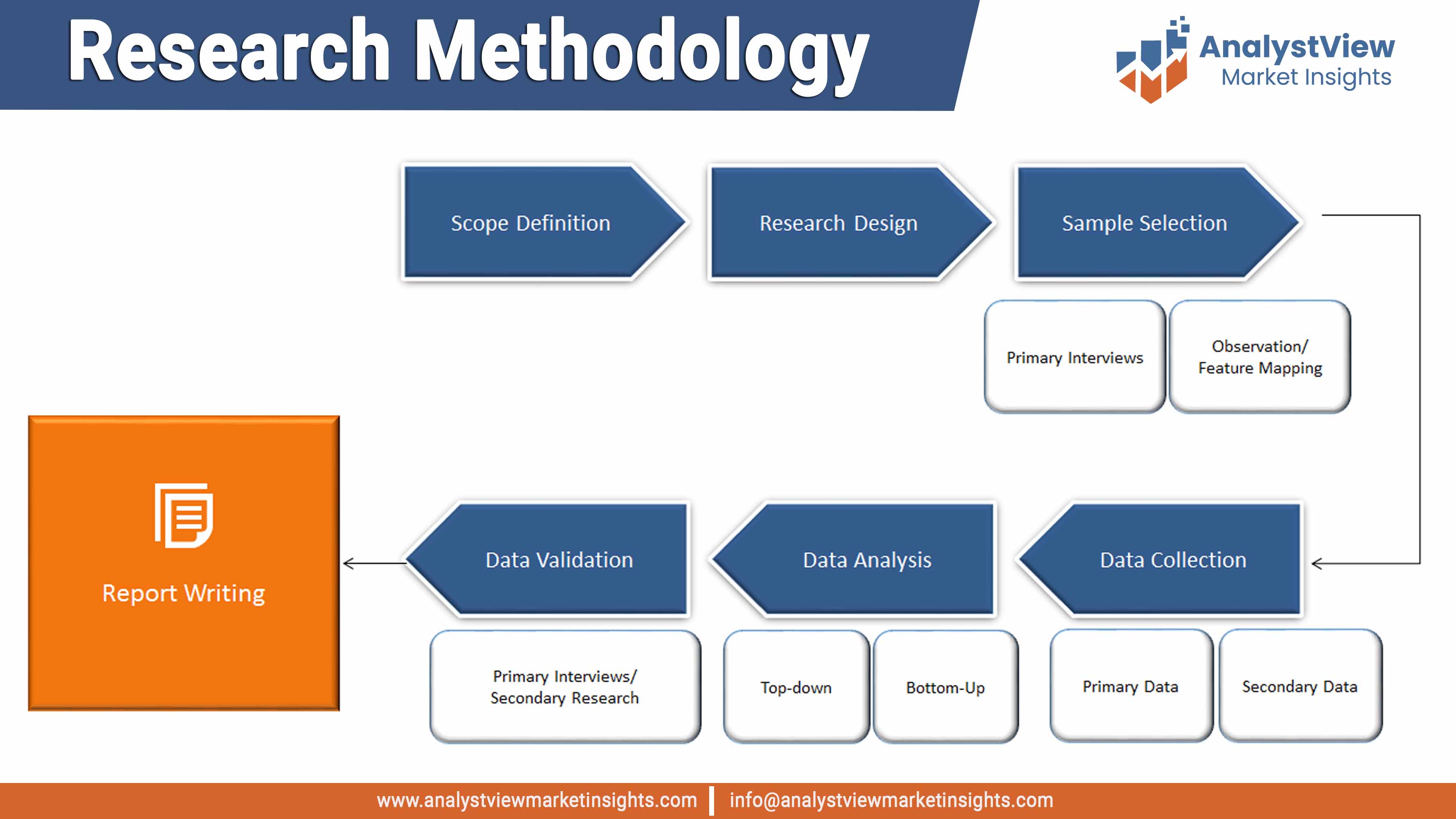

10.1. Research Methodology

10.2. References

10.3. Abbreviations

10.4. Disclaimer

10.5. Contact Us

List of Tables

TABLE List of data Products

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE U.S. Dredging Services market: Product snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE U.S. Dredging Services market, by Product, 2014-2025 (USD Million)

TABLE U.S. Dredging Services market: application snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by application

TABLE U.S. Dredging Services market, by application 2014-2025 (USD Million)

TABLE U.S. Dredging Services market: regional snapshot (2018)

List of Figures

FIGURE U.S. Dredging Services market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2017 & 2025

FIGURE Product segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Capital Dredging market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Remediation Dredging market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Maintenance Dredging market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Reclamation Dredging market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Beach Nourishment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Application segment market share analysis, 2017 & 2025

FIGURE Application segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Public infrastructure market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Public land market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Private projects market size forecast and trend analysis, 2014 to 2025 (USD Million)