U.S. Pharmacy Benefit Management (PBM) Market, By Business Model (Standalone, Health Insurance Providers, and Retail Pharmacy), By End Use (Commercial and Federal) Analysis, Size, Share, Trends, & Forecast from 2020-2026

REPORT HIGHLIGHT

The U.S. Pharmacy Benefit Management (PBM) market was valued at USD 370.2 billion by 2019, growing with 8.7% CAGR during the forecast period, 2020-2026.

Pharmacy benefit management (PBM) is a third-party prescription drug company that manages and provides programs for self-insured employer plans, state government employee plans, Medicare Part D plans, commercial health plans, and the Federal Employees Health Benefits Program. The PBM play a crucial role in maintaining and developing contacts with various contract based manufacturing pharmaceutical companies, negotiating discounts, rebates with drug manufacturers, and processing and paying prescription drug claims in the field of the pharmaceutical industry. According to the American Pharmacists Association, PBM has the authority to control the pharmacy prescription cost, hence reducing healthcare expenditure.

In addition to this, PBM also offers various clinical programs for large populations, medication therapy management programs, mail order service, and information of tablet splitting. The system also provides information related to the lower-cost therapeutic alternatives, as well as trials of specific medications in a therapeutic class with the help of its integrated healthcare system. The primary aim of such programs is to improve healthcare outcomes by reducing the drug costs for insurers, shaping patients’ access to medication, and many others.

Market Dynamics

The U.S. pharmacy benefit management market is primarily driven by increasing research and development activities in the field of specialty medicine and drugs. According to the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), in the U.S., research & development investments of pharmaceutical companies have shown significant growth. This would, in turn, fuel the industry demand to a great extent. In addition, due to the favorable government initiatives, the budget of publicly-funded National Institutes of Health as well as the R&D intensity has witnessed considerable growth of over 18% during the year 2018-2019. Furthermore, the rising number of pharmaceutical drug manufacturers, as well as the growing prevalence of chronic ailments like cardiovascular diseases, cancer, and diabetes are some of the important factors impelling the overall market growth.

The PBM facility in the U.S. has shown eminent growth for improving the physical and mental health of individuals as well as to reduce healthcare and hospitalization cost by providing cost-effective drugs prescription. The U.S. government is actively taking initiatives to support the PBMs objective of reducing healthcare costs by holding various patient assistance programs. According to the Pharmaceutical Care Management Association in 2019, the PBM and health plan has launched an initiative to apply manufacturer patient assistance programs to lower the monthly out-of-pocket costs on insulin by 40% or more for the patients suffering from diabetes. This program can benefit to save USD 25 out-of-pocket costs for a 30-month supply of insulin for eligible health plan enrollees. Such initiatives will boost industry growth during the forecast period.

Moreover, advancement in technologies in terms of artificial intelligence, healthcare apps, IoT for healthcare management, remote patient monitoring systems for recording healthcare data, and precision medication will stimulate the market demand significantly. In addition to this, increasing FDA approvals for pharmaceutical drugs and specialty medicines are likely to create lucrative growth opportunities in the pharmacy benefit management market during the study period.

Conversely, the complex nature of PBM contracts coupled with a lack of skilled professionals will pull back the market growth to some extent. However, it is noted that this service with the help of advanced technology using AI, IoT, etc can offer astounding benefits and enormous potential in the treatment of chronic ailments like cancer, diabetes, etc.

Business Model Takeaway

Depending upon the business model, the U.S. PBM industry is categorized into standalone, health insurance providers, and retail pharmacies. Of these, the health insurance providers accounted for the majority of market share in 2019. The segment growth is majorly attributed to the rising number of health insurance providers and growing awareness regarding such services among end-users. According to Pharmaceutical Care Management Association, the PBMs administer prescription drug plans that have been served over 270 million Americans with health insurance from the number of sponsors like union plans, Medicare Part D plans, commercial health plans, self-insured employer plans, etc. On the other hand, retail pharmacy is projected to grow with a promising growth rate during the forecast period.

End-user Takeaway

Based on end-user, the overall market is bifurcated into commercial and federal. Among these, the commercial segment has shown a leading role in the market in 2019. This dominance is attributed to a surge in the presence of the leading healthcare offices, healthcare professionals, physicians and market players. According to the World Health Organization (WHO), in the U.S., there are approximately 70 million physician office visits every year. In addition to this, the existence of pharmaceutical research-based products and drugs by major market players is anticipated to make a considerable contribution to the segmental growth in the future for commercial segments followed by the federal sector.

Regional Takeaway

In the North America region, the United States holds the highest share for the pharmacy benefit management (PBM) market owing to increasing the prevalence of the chronic ailments like diabetes, cancer, hypertension due to the rising geriatric population, unhealthy lifestyle and growing pharmaceutical industries. According to the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), the global pharmaceutical market was estimated to reach approximately USD 1,430 billion by 2020 out of which the United States has the highest share of up to 40.3% in 2015 and 41% share was estimated in 2020 for the pharmaceutical market. This pharmaceutical spending was highest in the United States due to the presence of advanced technology, rising healthcare expenditure, and availability of government & private funding are fuelling the United States pharmacy benefit management market growth.

COVID-19 Impact

The U.S. PBM market is striving to collectively help and to manage COVID-19 with intellects to save lives and restore the economy. During the Covid-19 pandemic, the public health emergency of PBM of the U.S. of health care system has been stepped up to manage millions of Americans who have health insurance by connecting physicians, pharmacies, and payers to work together to serve patients suffering from the coronavirus infection. The PBM in the United States has enabled access to medication with the rest of the drug supply chain to mitigate shortages during the outbreak of COVID-19 all over America. Hence the demand for the PBM market has been increased owing to increasing the favorable plans supporting the patients suffering from the COVID-19 to reduce the healthcare cost including the prescription price and other additional expenditures.

Key Vendor Takeaway

The leading players of the United States Pharmacy Benefit Management (PBM) market include Express Scripts, Cigna, Anthem, Rite Aid, Walgreens Booth Alliance, CVS Health, OptumRx, Aetna, MedImpact Healthcare Systems, and others.

Companies are actively involved in strategic mergers and acquisitions to capture a large customer base. In October 2018, CVS Health has completed the acquisition of Aetna, for gaining a strong position across the major vertical from the health care industry and for enhancing privacy controls, the consumer, and health insurance rate protections. The deal was made with approximately USD 70 Billion and in 2016 the CVS has also been acquired Derma Sciences for regenerative allograft products in the healthcare sector.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

UNITED STATES PHARMACY BENEFIT MANAGEMENT (PBM) MARKET KEY PLAYERS

- Express Scripts

- Cigna

- Anthem

- Rite Aid OptumRx

- Aetna

- CVS Health

- Walgreens Booth Alliance

- MedImpact Healthcare Systems

- Others

UNITED STATES PHARMACY BENEFIT MANAGEMENT (PBM) MARKET, BY BUSINESS MODEL

- Standalone

- Health Insurance Providers

- Retail Pharmacy

UNITED STATES PHARMACY BENEFIT MANAGEMENT (PBM) MARKET, BY END USERS

- Commercial

- Federal

TABLE OF CONTENT

1. UNITED STATES PHARMACY BENEFIT MANAGEMENT (PBM) MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Business Model

2.1.2. Market Snippet by End User

2.2. Competitive Insights

3. U.S. PHARMACY BENEFIT MANAGEMENT (PBM) KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. U.S. PHARMACY BENEFIT MANAGEMENT (PBM) INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

4.5. COVID-19 Impact Analysis

4.5.1. Pre-COVID-19 Impact Analysis

4.5.2. Post-COVID-19 Impact Analysis

5. U.S. PHARMACY BENEFIT MANAGEMENT (PBM) MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. U.S. PHARMACY BENEFIT MANAGEMENT (PBM) MARKET – BY BUSINESS MODEL

6.1. Overview

6.1.1. Segment Share Analysis, By BUSINESS MODEL, 2019 & 2026 (%)

6.2. Health Insurance Providers

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3. Standalone

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4. Retail Pharmacy

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7. U.S. PHARMACY BENEFIT MANAGEMENT (PBM) MARKET – BY END USER

7.1. Overview

7.1.1. Segment Share Analysis, By End User, 2019 & 2026 (%)

7.2. Federal

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3. Commercial

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8. KEY VENDOR ANALYSIS

8.1. Walgreens Booth Alliance

8.1.1. Company Snapshot

8.1.2. Financial Performance

8.1.3. Product Benchmarking

8.1.4. Strategic Initiatives

8.2. Cigna

8.3. MedImpact Healthcare Systems

8.4. Anthem

8.5. Express Scripts

8.6. Rite Aid

8.7. OptumRx

8.8. Aetna

8.9. CVS Health

8.10. Others

9. 360 DEGREE ANALYST VIEW

10. APPENDIX

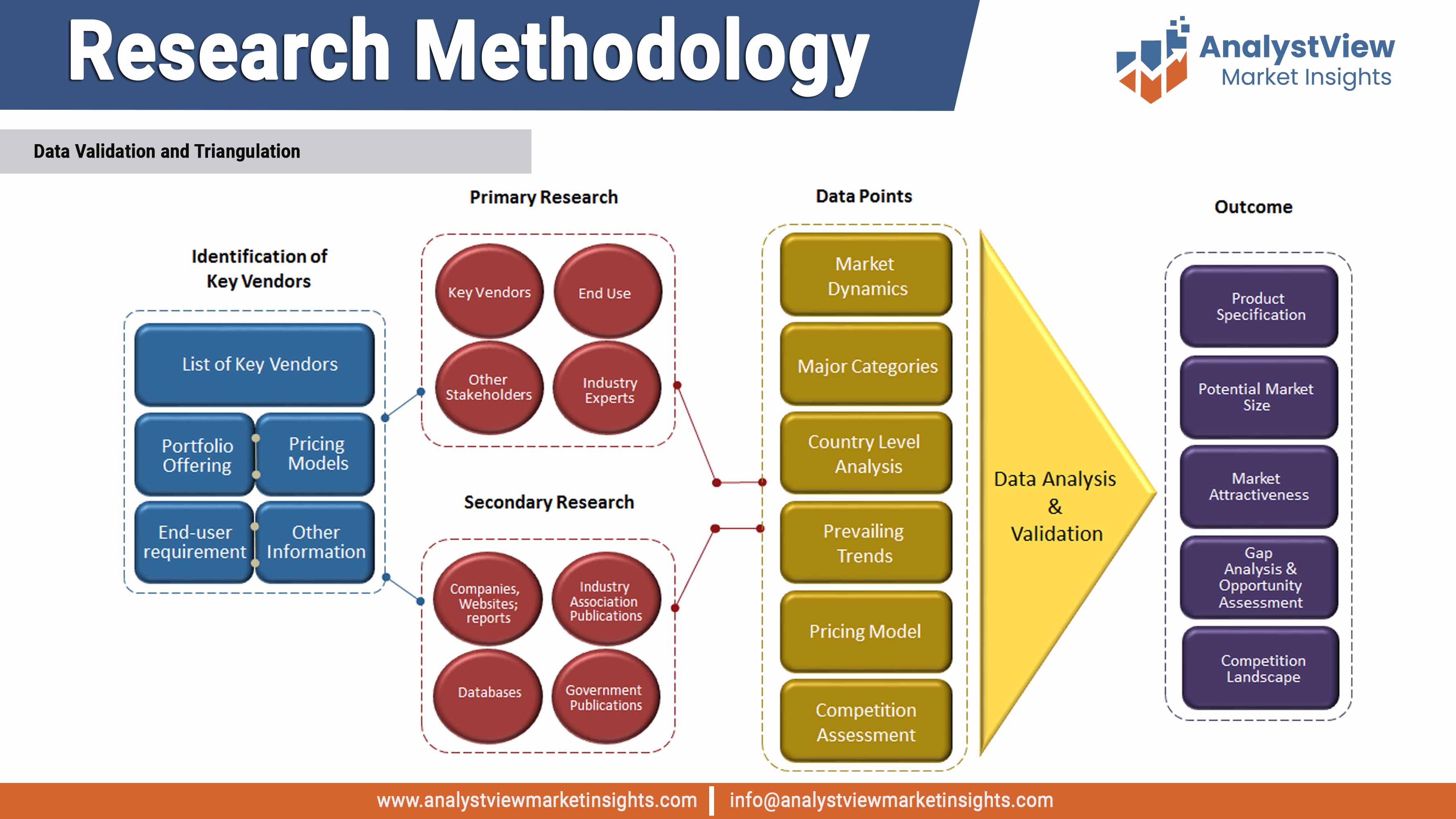

10.1. Research Methodology

10.2. References

10.3. Abbreviations

10.4. Disclaimer

10.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE U.S. Pharmacy Benefit Management (PBM) market: Business Model Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Business Model

TABLE U.S. Pharmacy Benefit Management (PBM) market, by Business Model 2015-2026 (USD Million)

TABLE U.S. Pharmacy Benefit Management (PBM) market: End User Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by End User

TABLE U.S. Pharmacy Benefit Management (PBM) market, by End User 2015-2026 (USD Million)

TABLE U.S. Pharmacy Benefit Management (PBM) market, 2015-2026 (USD Million)

List of Figures

FIGURE U.S. Pharmacy Benefit Management (PBM) market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE COVID-19 Impact Analysis

FIGURE Pre & Post COVID-19 Impact Comparision Study

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Business Model segment market share analysis, 2019 & 2026

FIGURE Business Model segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Standalone market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Health Insurance Providers market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Retail Pharmacy market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE End User segment market share analysis, 2019 & 2026

FIGURE End User segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Commercial market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Federal market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Country segment market share analysis, 2019 & 2026

FIGURE Country segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE U.S. Pharmacy Benefit Management (PBM) market share and leading players, 2018