U.S. Plumbing Services Market, By Types (General Plumbing Services, Mechanical Contracting Services, Sprinkler Installation Services, And Steam and Pipefitting Services), By Services, and Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

REPORT HIGHLIGHT

The U.S. plumbing services market was valued at USD 980 million by 2017, growing with 5.0% CAGR during the forecast period, 2018-2025

Plumbing services industry is growing due to the technological advances which improves product and appliance installation. Advancement in technologies has introduced infrared inspection cameras that used to pinpoint pipe blockages and rainwater catchment systems. In addition, increasing number of residential and non-residential buildings will spur the demand for industry significantly. However, demand for plumbing services is adversely influenced by fluctuations in building and construction activity.

Types Takeaway

In terms of types, the market is categorized as;

- General plumbing services

- Mechanical contracting services

- Sprinkler installation services

- Steam and pipefitting services

General plumbing services is the major market. These services include the installation, repair and maintenance of water distribution pipes and appliances, water heaters, garbage disposals, bathroom and kitchen sinks, water pipes and other plumbing.

Services Takeaway

Based on services, the market is categorized as;

- Residential buildings

- Retail and storage spaces

- Industrial and office buildings

- Others

Plumbing service franchises are service oriented, and there is no international trade within this industry as goods are not passed from one country to another. In particular, the residential building construction market is expected to be a strong driver for plumbing service franchises.

Key Vendors Takeaway

- Chemed Corporation

- Jon Wayne Service Company

- The Dwyer Group

- Roto-Rooter Plumbing & Water Cleanup

- US Plumbing Inc

- Clockwork Home Services, Inc

- Rooter-Man

The Plumbing Service Franchises industry is in a mature stage of its life cycle. The industry benefits from stable demand from homes and businesses that need repair and maintenance of water delivery systems Plumbing services have shown incremental change over the long term, with technological advances generally improving the ease of product and appliance installation.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY TYPES

- General Plumbing Services

- Mechanical Contracting Services

- Sprinkler Installation Services

- Steam and Pipefitting Services

MARKET, BY SERVICES

- Residential Buildings

- Retail and Storage Spaces

- Industrial and Office Buildings

- Others

TABLE OF CONTENT

1. U.S. PLUMBING SERVICES MARKET OVERVIEW

1.1. Study Scope

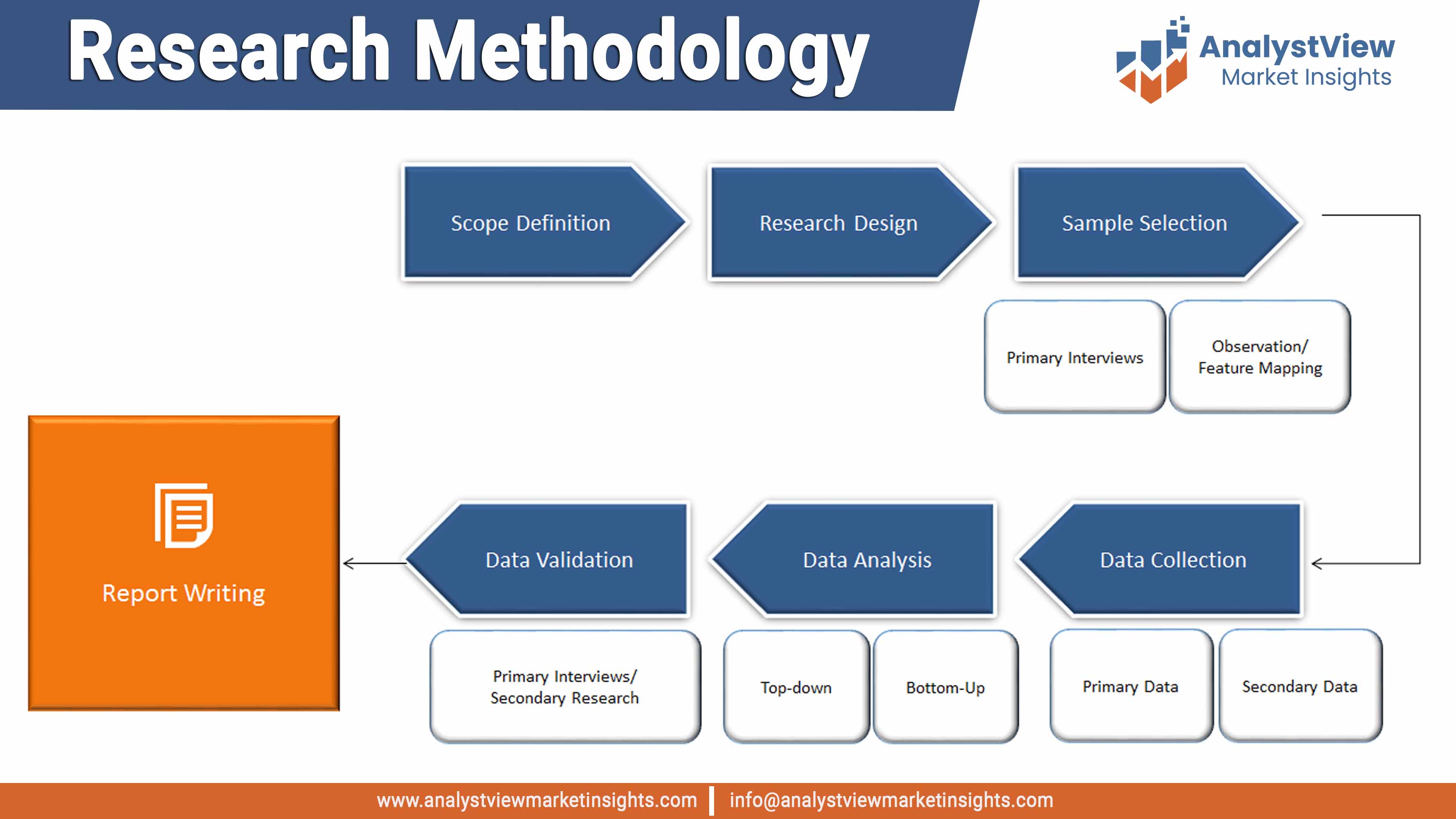

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Types

2.1.2. Market Snippet by Services

2.2. Competitive Insights

3. U.S. PLUMBING SERVICES KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. U.S. PLUMBING SERVICES INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

5. U.S. PLUMBING SERVICES MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. U.S. PLUMBING SERVICES MARKET – BY TYPES

6.1. Overview

6.1.1. Segment Share Analysis, By Types, 2017 & 2025 (%)

6.2. General plumbing services

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.3. Mechanical contracting services

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.4. Sprinkler installation services

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

6.5. Steam and pipefitting services

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7. U.S. PLUMBING SERVICES MARKET – BY SERVICES

7.1. Overview

7.1.1. Segment Share Analysis, By Services, 2017 & 2025 (%)

7.2. Residential buildings

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.3. Retail and storage spaces

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.4. Industrial and office buildings

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

7.5. Others

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Million)

8. KEY VENDOR ANALYSIS

8.1. Chemed Corporation

8.1.1. Company Snapshot

8.1.2. Financial Performance

8.1.3. Types Benchmarking

8.1.4. Strategic Initiatives

8.2. Jon Wayne Service Company

8.2.1. Company Snapshot

8.2.2. Financial Performance

8.2.3. Types Benchmarking

8.2.4. Strategic Initiatives

8.3. The Dwyer Group

8.3.1. Company Snapshot

8.3.2. Financial Performance

8.3.3. Types Benchmarking

8.3.4. Strategic Initiatives

8.4. Roto-Rooter Plumbing & Water Cleanup

8.4.1. Company Snapshot

8.4.2. Financial Performance

8.4.3. Types Benchmarking

8.4.4. Strategic Initiatives

8.5. US Plumbing, Inc.

8.5.1. Company Snapshot

8.5.2. Financial Performance

8.5.3. Types Benchmarking

8.5.4. Strategic Initiatives

8.6. Clockwork Home Services, Inc.

8.6.1. Company Snapshot

8.6.2. Financial Performance

8.6.3. Types Benchmarking

8.6.4. Strategic Initiatives

8.7. Rooter-Man

8.7.1. Company Snapshot

8.7.2. Financial Performance

8.7.3. Types Benchmarking

8.7.4. Strategic Initiatives

9. 360 DEGREE ANALYSTVIEW

10. APPENDIX

10.1. Research Methodology

10.2. References

10.3. Abbreviations

10.4. Disclaimer

10.5. Contact Us

List of Tables

TABLE List of data Types

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE U.S. Plumbing Services market: Types snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Types

TABLE U.S. Plumbing Services market, by Types, 2014-2025 (USD Million)

TABLE U.S. Plumbing Services market: Services snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Services

TABLE U.S. Plumbing Services market, by Services 2014-2025 (USD Million)

List of Figures

FIGURE U.S. Plumbing Services market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Types segment market share analysis, 2017 & 2025

FIGURE Types segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE General plumbing services market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Mechanical contracting services market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Sprinkler installation services market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Steam and pipefitting services market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Services segment market share analysis, 2017 & 2025

FIGURE Services segment market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Residential buildings market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Retail and storage spaces market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Industrial and office buildings market size forecast and trend analysis, 2014 to 2025 (USD Million)

FIGURE Other market size forecast and trend analysis, 2014 to 2025 (USD Million)