Water and Wastewater Treatment Market, By Types (Technologies, Chemical and Equipment & Services), By End Use (Municipal, and Industrial) and Geography (NA, EU, APAC, and RoW) Analysis, Share, Trends, Size, & Forecast From 2014 2025

|

Report ID

AV204

|

Published Date

July 2021

|

Pages

159

|

Industry

Bulk Chemicals

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

The water and wastewater treatment market is estimated to represent a global market of USD 492.1 billion by 2017 with growth rate of 3.8%.

Market Dynamics

The water treatment industry has evolved significantly over the past few years owing to the technology up-gradation and rising consumer demand. This market covers an extensive and diverse range of applications across plants having varied sizes, applications and critical processes. The demand for water pre-treatment in the industrial sector is increasing constantly with the rise in demand for safe water and surging demographics. For instance, acceptance of feed water treatment in the various industrial sector is catching up in order to meet the silt density index so as to prevent its equipment from corrosion. Industrial wastewater treatment sector has witnessed a significant shift from traditional filtration methodology to ultra & non-membrane filtration systems or efficient centrifugal filters. This constant evolution in water treatment technologies has resulted in enhanced quality wastewater discharge and introduced the trend towards reuse of wastewater.

Increasing residential and commercial industry is also anticipated to contribute significantly to the growth of this market over the study period. Furthermore, market growth is attributed to the rising demand for the tubular micro-filtration system for chemical softening coupled with hollow fiber membrane filters to remove turbidity for sanitary plant discharges. On the flip side, the absence of efficient infrastructure facilities could be a restraining factor for industry development. Compliance with the government’s wastewater quality standards is also considered to be one of the barriers for the players to enter this market.

Types Takeaway

In terms of types, the market is divided as technology, chemical and equipment & services. Of these, equipment & services accounted for the major chunk of the industry revenue throughout the forecast period. Sludge equipment and membrane separation equipment are some of the products considered under this segment. The end-user segment is categorized as municipal and industrial.

Regional Takeaway

Regionally, developed regions (North America and Europe) accounted for more than 40% revenue share, collectively. In developed regions, this market is considered to be the capital intensive and is characterized by high operational costs. According to the American Society of Civil Engineers (ASCE), there are around 14,750 water treatment plants in the U.S. alone, serving over 70% of the population. As per the studies, more than 55 Billion users are projected to connect to the water utilities in the U.S. by 2032, the demand for water treatment facilities is anticipated to increase significantly over the forecast period.

Whereas, Asia Pacific countries captured the highest revenue share, i.e. 44.98% in 2017 and is projected to dominate the market during the study period. This region presents potential opportunities for this industry due to favorable factors, such as government regulations in terms of ensuring the quality standards of treated water, and abundant water capacity. Furthermore, Middle East countries are considered to be an important for this market. For instance, according to various studies, the Gulf Cooperation Council has an approximate of USD 40 billion worth of wastewater treatment projects in the coming ten years. This, would, in turn, establish a healthy platform for industry growth.

Key Vendor Takeaway

Companies namely 3M Purification, WAMGROUP S.p.A., Calgon Carbon, Aquatech International LLC, Danaher Corporation, Degremont, and Siemens are actively operating in this industry. In addition to that, the water and wastewater treatment industry consists of various service providers (e.g. ChemTreat) which offer various solutions for plant maintenance. Strategic collaborations are one of the key strategies adopted by these players. For instance, Veolia acquired Kurlon, US-based nuclear and radioactive waste treatment provider, in April 2017. This acquisition is aimed to expand Veolia’s waste treatment portfolio to radioactive and nuclear waste management.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2014 & 2016

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2025

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies and Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MARKET, BY TYPES

- Technologies

- Chemical

- Equipment & Services

MARKET, BY END USE

- Municipal

- Industrial

MARKET, BY REGION

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Rest of Europe

- Asia Pacific

- India

- China

- Rest of APAC

- Rest of the World

- Middle East and Africa

- Latin America

TABLE OF CONTENT

1. WATER AND WASTEWATER TREATMENT MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Key Market Facts

2.2. Geographical Scenario

2.3. Companies in the Market

3. WATER AND WASTEWATER TREATMENT KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. WATER AND WASTEWATER TREATMENT INDUSTRY STUDY

4.1. Porter’s Analysis

4.2. Market Attractiveness Analysis

4.3. Regulatory Framework Analysis

5. WATER AND WASTEWATER TREATMENT MARKET LANDSCAPE

5.1. Market Share Analysis

6. WATER AND WASTEWATER TREATMENT MARKET – BY TYPES

6.1. Overview

6.2. Technologies

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.3. Chemical

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

6.4. Equipment & Services

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7. WATER AND WASTEWATER TREATMENT MARKET – BY END USE

7.1. Overview

7.2. Municipal

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

7.3. Industrial

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8. WATER AND WASTEWATER TREATMENT MARKET– BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. Overview

8.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.3. U.S.

8.2.3.1. Overview

8.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.2.4. Canada

8.2.4.1. Overview

8.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3. Europe

8.3.1. Overview

8.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.3. France

8.3.3.1. Overview

8.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.4. Germany

8.3.4.1. Overview

8.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.3.5. Rest of Europe

8.3.5.1. Overview

8.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.3. China

8.4.3.1. Overview

8.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.4. India

8.4.4.1. Overview

8.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.4.5. Rest of APAC

8.4.5.1. Overview

8.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5. Rest of the World

8.5.1. Overview

8.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.3. Latin America

8.5.3.1. Overview

8.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

8.5.4. Middle East and Africa

8.5.4.1. Overview

8.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

9. KEY VENDOR ANALYSIS

9.1. 3M Purification

9.1.1. Company Overview

9.1.2. SWOT Analysis

9.1.3. Key Developments

9.2. WAMGROUP S.p.A.

9.2.1. Company Overview

9.2.2. SWOT Analysis

9.2.3. Key Developments

9.3. Calgon Carbon

9.3.1. Company Overview

9.3.2. SWOT Analysis

9.3.3. Key Developments

9.4. Aquatech International LLC

9.4.1. Company Overview

9.4.2. SWOT Analysis

9.4.3. Key Developments

9.5. Carus Corporation

9.5.1. Company Overview

9.5.2. SWOT Analysis

9.5.3. Key Developments

9.6. Chemours Co

9.6.1. Company Overview

9.6.2. SWOT Analysis

9.6.3. Key Developments

9.7. ChemTreat, Inc.

9.7.1. Company Overview

9.7.2. SWOT Analysis

9.7.3. Key Developments

9.8. Ecolab

9.8.1. Company Overview

9.8.2. SWOT Analysis

9.8.3. Key Developments

9.9. BASF

9.9.1. Company Overview

9.9.2. SWOT Analysis

9.9.3. Key Developments

9.10. Danaher Corporation

9.10.1. Company Overview

9.10.2. SWOT Analysis

9.10.3. Key Developments

9.11. Degremont

9.11.1. Company Overview

9.11.2. SWOT Analysis

9.11.3. Key Developments

9.12. Siemens

9.12.1. Company Overview

9.12.2. SWOT Analysis

9.12.3. Key Developments

*Client can request additional company profiling as per specific requirements

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

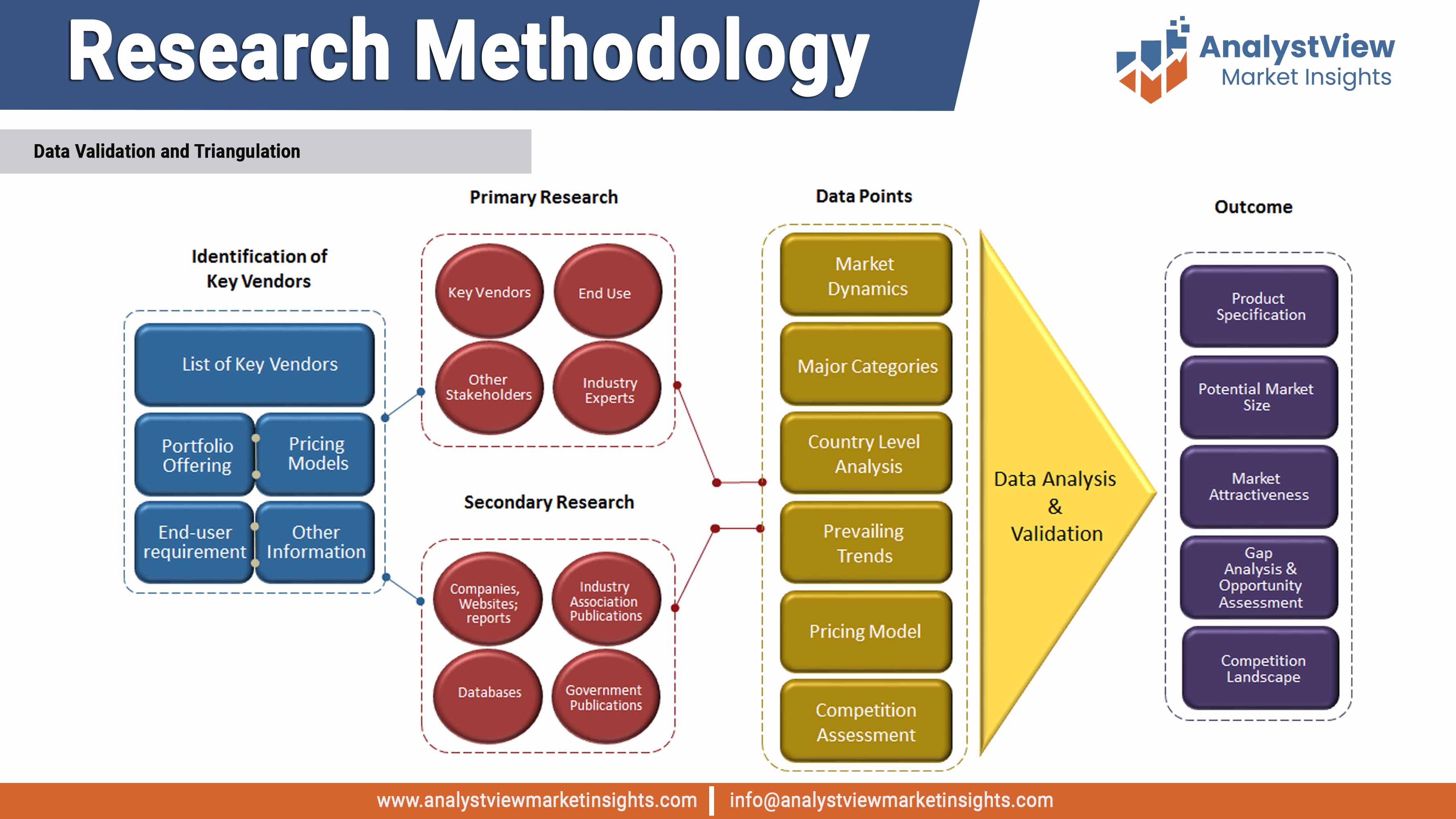

11.1. Research Methodology

11.2. Abbreviations

11.3. Disclaimer

11.4. Contact Us

List of Tables

Table 1 List of Acronyms

Table 2 Key Market Facts, 2014 – 2025

Table 3 Market Drivers: Impact Analysis

Table 4 Market Restraint: Impact Analysis

Table 5 Market Opportunity: Impact Analysis

Table 6 PEST Analysis

Table 7 Porter’s Five Forces Analysis

Table 8 Company Market Share Analysis

Table 9 Global Water and Wastewater Treatment Market Analysis, Forecast, and Y-O-Y Growth Rate, 2014 – 2025, (US$ Billion)

Table 10 Water and Wastewater Treatment Market, by Types, 2014 – 2025 (USD Billion)

Table 11 Water and Wastewater Treatment Market, by End Use, 2014 – 2025 (USD Billion)

Table 12 Water and Wastewater Treatment Market, by Geography, 2014 – 2025 (USD Billion)

Table 13 North America Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 14 U.S. Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 15 Canada Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 16 Europe Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 17 France Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 18 Germany Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 19 Asia Pacific Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 20 China Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 21 India Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 22 Latin America Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

Table 23 MEA Water and Wastewater Treatment Market, 2014 – 2025 (USD Billion)

List of Figures

Figure 1 Research Methodology

Figure 2 Research Process Flow Chart

Figure 3 Comparative Analysis, by Geography, 2016-2025 (Value %)

Figure 4 Regulatory Framework Analysis

Figure 5 Water and Wastewater Treatment Market, by Types, 2014 – 2025 (USD Billion)

Figure 6 Water and Wastewater Treatment Market, by End Use, 2014 – 2025 (USD Billion)

Figure 7 Water and Wastewater Treatment Market, by Geography, 2014 – 2025 (USD Billion)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS